NICs hike: call for recruitment agencies and end clients to pay up for umbrella contractors

Recruitment agents and their end clients need to “step up to the plate and increase assignments fees to cover the cost to the worker”, according to the FCSA’s CEO, Chris Bryce.

The FCSA’s call for higher contractor pay, especially for umbrella company workers, comes just weeks before the Chancellor will impose an increase in both employers’ and employees’ National Insurance Contributions (NICs) on April 6th 2022.

The increase being imposed is 1.25 percentage points meaning the actual rise is about 9% for employers and 10% for employees.

As Bryce explains in a recent blog the hike in NICs, which is to become the Health and Social Care Levy next year, will result in many umbrella workers losing almost 2.5% of their current take-home pay rather than the 1.25% of regular employees. This is at the time of spiralling inflation and massive rises in gas, petrol, electricity and food bills.

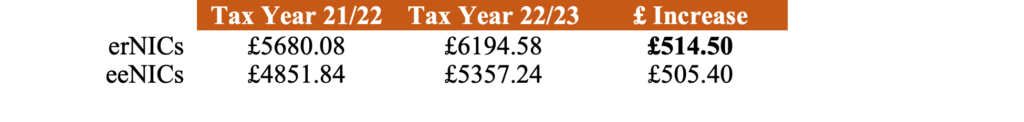

From April 2022, any umbrella company employee earning £50,000 per year, will like all other employees, pay an extra £505.40 in employees’ NICs, but their take-home pay will also suffer further because of the extra £514.50 of employers’ NICs.

“This is clearly unfair,” said Bryce, “and we are asking FCSA members to work with their supply chain, the employment agencies and end-users, to ensure that the end-users increase assignment rates to account for this rise so that the extra burden caused by the NICs increase does not fall on the worker.

“FCSA is also urging the Chancellor to cancel these increases in NICs altogether or, failing that, to introduce an amendment requiring the end-users to increase the assignment rates paid to their freelancers to account for the rise in employer NICs.”

“For some time, most freelancers working for end clients through an umbrella company have been driven by the off-payroll working rules so that their take-home pay reflects both employees NICs (eeNICs) and employers NICs (erNICs). Whilst at first glance this may seem strange and unfair, it is nevertheless true and is explained by HMRC here,” said Bryce.

This smack of injustice is largely due to Off-Payroll rules that force contractors to use umbrella companies to pay for the privilege to work. They then must fund out of their own pocket umbrella company pay-roll administration costs on top of “employers NICs”. If contractors are an umbrella company’s employees, shouldn’t the umbrella, the employer, be forking out the additional employer national insurance?

Higher rates may not be the only answer

As previously reported by FI, higher contractor rates, while welcome could be eaten up by inflation and being boosted into a higher tax bracket. Great Britain’s Office for Budget Responsibility changed its forecasts to reflect higher inflation, which means not only will more people be paying taxes, but more people will be pushed into higher tax bands, according to HMRC findings.

Those that have received a pay rise in the past year may have been no better off. This was particularly the case for umbrella company contractors that felt compelled to increase their rates to keep their take-home pay in line with previous years. Some contractors, however, are worse off in 2022 due to a host of events and government tax policies.

To read the full report, click here.

Take holiday pay earlier rather than later

In light of cases where umbrella company workers are not seeing all of their holiday pay at the end of the work year, as highlighted in a previous FI report, some umbrella company workers may choose to take their holiday pay in advance in their weekly or monthly payslip and place that amount in savings with limited access so they actually keep it for time off. This can be done by creating a standing order with your bank for a set amount that goes into a specific savings account.

Rebecca Seeley Harris, an Off-Payroll and IR35 expert, explained in a LinkedIn post that the decision on the “never-ending saga of Smith v. Pimlico Plumbers [2022] EWCA Civ 70” will act as an industry marker when it comes to worker rights to annual paid leave.

“A worker can only lose this right if the employer can specifically and transparently show that they gave the worker the opportunity to take paid annual leave, encouraged the worker to take paid annual leave and informed the worker that the right would be lost at the end of the year,” said Seeley in her post.

If your umbrella company goes bust, then there could be a limited chance you would see some unpaid wages or holiday pay. To read about your rights should your umbrella company goes insolvent, read more here in our Tax Clinic.

Related articles

NI threshold raised to £12,570 but some freelancers will be worse off next year says expert