How to preserve your reputation when things go wrong as a freelancer

Those freelancers and business owners that have had to make a professional indemnity claim over the course of the pandemic, such as wedding photographer Lucy English* have seen the benefits of cover both to preserving their professional reputation and bank balance, according to PolicyBee’s annual claims report.

Many freelancers will question whether the cost of professional indemnity insurance is worth the cost. Others do not have a choice in the matter as some clients make it a requirement and part of the freelancer contract.

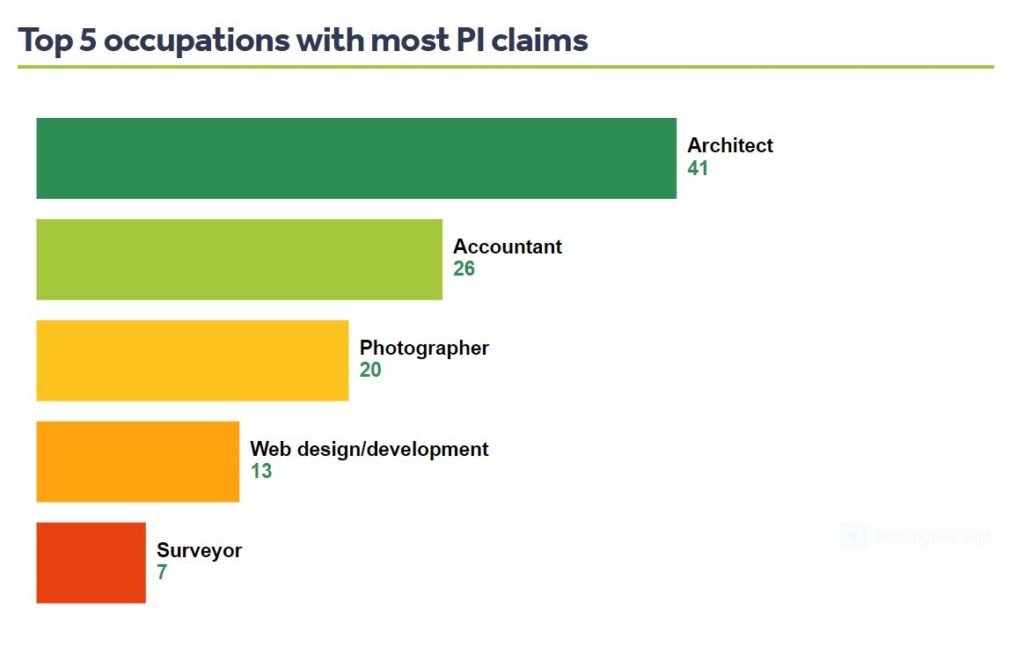

It would seem that finding professional indemnity insurance has proved an increasing challenge for architecture and construction businesses in recent years. Architecture businesses make up just 6% of all policies and 10% of total value at broker PolicyBee, yet made over a third of PI claims in 2020.

What went wrong for the construction industry?

The construction industry had its fair share of issues over the past year, such as a rising number of failed basement conversions and concerns over cladding and buildings since the Grenfell Tower disaster. More insurers are deeming construction and architecture as high-risk sectors and those working in the industry are paying the price.

According to the PolicyBee report some insurers have pulled out of offering cover all together, raised premiums and excesses by up to 400%, or introduced major exclusions within their policies. If companies can get cover, it is not always fit for purpose. The average capacity per underwriter halved in the last 18 months from £5 million to £2.5 million.

Rising premiums

The rising premiums are making self-employed architects, design consultants and contractors seriously consider throwing in the towel, according to a Building Design report.

“Unfortunately, we expect challenges surrounding PI insurance to remain for a few years yet,” said Yasin Akdemir, architects’ insurance specialist at PolicyBee.

“As well as rising premiums, policy renewals are another area of concern for architects as some insurers are ceasing to provide cover for the industry. Others are asking for far more information from customers than they used to, which of course takes time and can cause a bit of a paperwork headache for architects. This means the entire renewals process is taking longer so architects need to start thinking about it earlier than they usually might.”

With architects continuing to make large numbers of PI claims, the need for comprehensive cover remains as much a priority to businesses as ever, so going to a specialist broker may be the only option they have.

PolicyBee Claim Case study

Lucy English*, wedding photographer

Lucy’s been a photographer for nine years and a PolicyBee customer for eight. All was well until a particular wedding day in February 2020.

Lucy was personally pleased with the photos and thought they were the best ones she’s ever taken at a venue she was familiar with. No issues were raised on the day – in fact the groom said he was really happy with the photos.

The email that caught Lucy off guard

A few weeks after the wedding day she sent the photos over to the couple, but didn’t hear anything from them. However, a few weeks later, Lucy got a very negative email, criticising the photos and asking for money back.

At this point she asked PolicyBee for help. She’d read about what to do if and when a claim hit and knew getting in touch with her insurer at the first sign of trouble was best.

Jane, a claims team leader, helped her put an initial response together. Each time Lucy had a reply from her client, Jane advised what to say and what not to say in her reply. In that time, PolicyBee reviewed the pictures in question to see if the client had a right to refund. They advised not to offer one.

Naturally, this claim was the last thing Lucy needed. The impact of coronavirus was making its presence felt and all her work for 2020 had been cancelled. A knock to her confidence and a possible financial hit were particularly unwelcome.

Thankfully, through effective communication, Lucy didn’t have to refund her client. Because there was no settlement made, she didn’t have to pay her excess either. So, although the initial incident caused stress and worry she really didn’t need, there were no lasting effects on her business – not even a poor review on Facebook.

Lessons learned

“In hindsight I wish I’d insisted on meeting with the couple face to face before their wedding and make sure they are completely happy with my style. I would recommend any other photographers to do the same.

“Although I was sure I’d delivered my service as expected, I appreciated the reassurance from PolicyBee that that was the case. Jane’s’ understanding and fast work really helped resolve the situation and minimise stress.”

*Names have been changed

How to claim

The first step to getting your claim paid is making sure all boxes are ticked and your insurer has everything they need. This is PolicyBee’s process:

Call your broker as soon as you’re aware of:

- Any shortcoming in your work that’s likely to lead to a claim against you

- Any criticism of your work, even if you consider it unjustified. It could still lead to a claim.

- Any threat of a claim against you, even one seemingly made in passing.

- Any persistent complaint about your work.

- Any refusal by a client to pay you for your work

- Any suspicion you might have that a partner, employee, director or self-employed freelancer may have acted dishonestly

Late notification is a common reason for insurers to ‘repudiate’ (reject) claims

What not to do

- Admit liability

This prejudices your insurer’s position and, obviously, makes it more difficult to fight your corner. - Settle the claim yourself

You need your insurer’s permission before paying your claimant anything. Besides which, why spend your own money? - Tell the person claiming against you that you have insurance (if they don’t already know)

Finding out you have the financial muscle of an insurer behind you can mean a couple more zeros get added to their alleged costs. - Call your solicitor

Your insurance covers the legal costs of a claim against you. Your insurer’s legal team has the expertise to defend you in the early stages, potentially resolving a problem before it escalates. Using your own solicitor means paying legal costs yourself, and running the risk of your insurer withdrawing cover for any compensation.