Cheapest places to get on the property ladder in the UK

Scotland takes top spot for most affordable for first-time buyers in the UK

A recent study by L&C Mortgages reveals the most affordable areas in the UK to purchase a property, and Scotland dominates the top of the list.

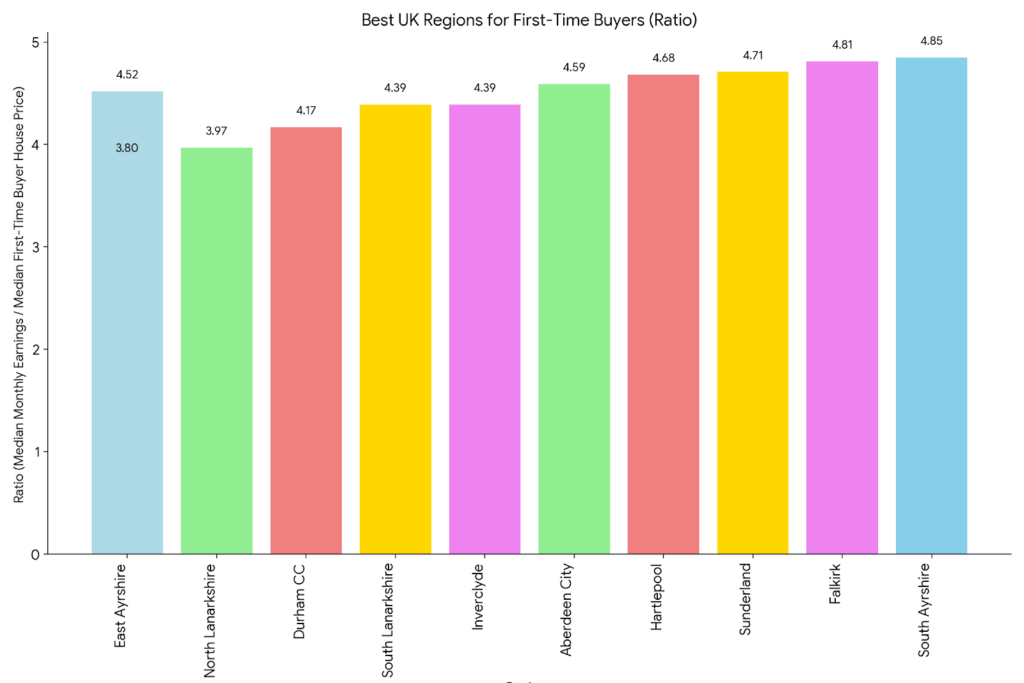

The study analysed median first-time buyer house prices and salaries across the UK to determine affordability. East and North Ayrshire take the crown, boasting the lowest median house price for first-time buyers at a remarkable £103,453. Coupled with a decent median monthly salary of £2,268, this region offers an attractive house price-to-income ratio of 3.8, making it the most affordable place to buy a house in the UK.

Following closely behind is North Lanarkshire, another Scottish region. Here, first-time buyers can expect a median house price of £112,166 and a median monthly salary of £2,355, resulting in a ratio of 3.97.

Several other Scottish areas also rank highly, including South Lanarkshire, Inverclyde, East Renfrewshire, and Renfrewshire (all tied at 4.39), and East Lothian (4.52). These regions offer a good balance between affordability and quality of life, often situated near larger cities like Glasgow.

England: which regions should first-time buyers consider?

For those seeking options outside of Scotland, County Durham in England comes in third place with a ratio of 4.17. Here, the median house price sits at £111,454 with a median monthly salary of £2,229.

Further down the list, several towns in northern England like Hartlepool, Stockton-on-Tees, and Sunderland offer affordability with a more modest cost of living.

The study highlights the stark contrast between Scotland and London. London boroughs like Kensington & Chelsea and Hammersmith & Fulham have the highest house prices, making them the least affordable for first-time buyers.

What’s your house price-to-income ratio?

Overall, the research is a helpful tool for aspiring homeowners, particularly those struggling to save for a down payment in a competitive market. By focusing on areas with a favourable house price-to-income ratio, first-time buyers can increase their chances of achieving homeownership.

On the other end of the scale, numerous areas in London emerged as the least favourable options for first-time buyers, with low median salaries and staggeringly expensive properties.

Kensington and Chelsea and Hammersmith and Fulham topped the list as the least cost-effective areas for first-time buyers. The area’s median first-time buyer house price was a staggering £792,899, with monthly earnings of just £3,261 – making this the most challenging and inaccessible market for first-time buyers in the UK.

Unsurprisingly, the research revealed that the top ten most expensive areas are all located in London – including Westminster, Camden and City of London, Haringey and Islington, Hackney and Newham, Brent, Hounslow, and Richmond upon Thames, Barnet, Redbridge and Waltham Forest and finally Enfield.