For three decades the UK’s office-based or white-collar workers have enjoyed (for the most part), stable, job security. Today, as the UK and other nations around the world face the possibility of another COVID-19 spike, white-collar workers are experiencing the worst jobs crisis since the early 1990s recession, according to Tej Parikh, Chief Economist at the Institute of Directors.

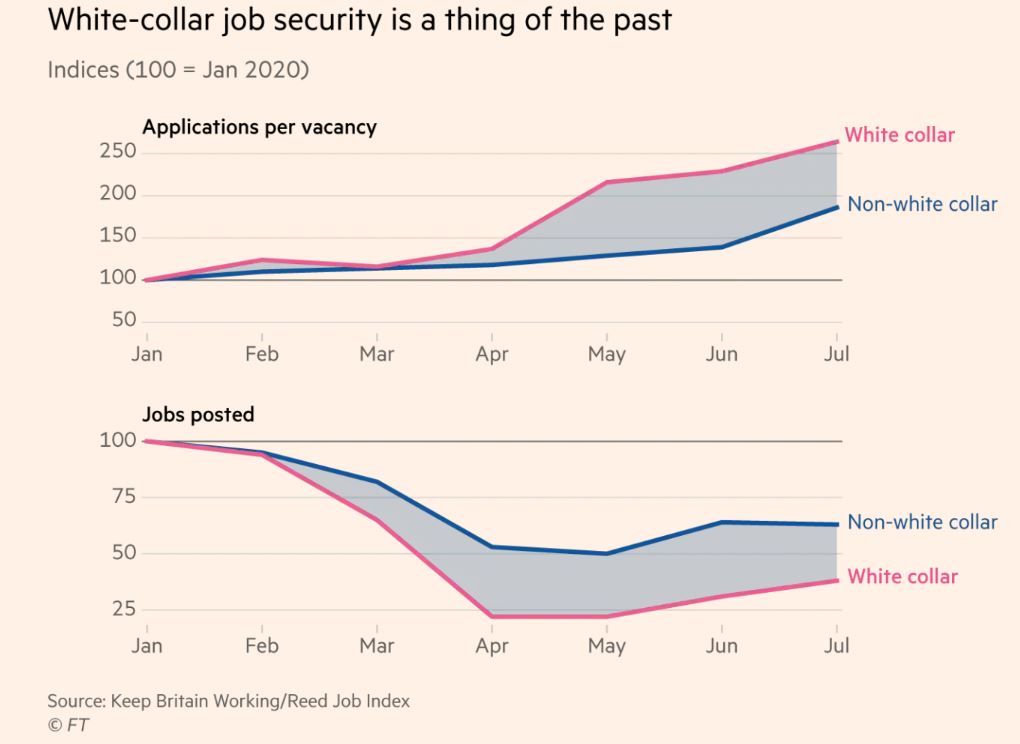

However, in a twist of fate, blue-collar workers, who have usually been the hardest hit workers in previous recessions are seeing job posting figures supersede those of office workers by close to 20%, according to research conducted by the Reed Job Index and the Keep Britain Working Campaign.

Applicant overload

The Financial Times reported that the three jobs that received the highest number of applications in July 2020 were junior white-collar roles. To put things into perspective, jobs site, CV-Library, for the same period reported that Trainee paralegal applications exceeded 4,200, and more than 3,000 applying for both HT assistant and trainee accountant jobs. Prior to the recent pandemic, the average number of applications for any vacancy was 25.

What does this mean for recruitment firms? A lot of admin, manhours and manpower and/or artificial intelligence tools for screening candidates. This unprecedented challenge for recruitment firms means internal resources will be spread even thinner, in areas such as accounts payable and contractor payroll responsibilities, yet the number of job openings is not commensurate with the number of applicants.

Economy ‘reshaping’ – why white-collar workers have the blues

For those recruitment firms that satisfy both white and blue-collar candidate roles, the reshaping of the economy is forming right before their eyes; many having to adjust their internal resources accordingly.

For example, some sectors are booming, namely, those that are tech-enabled or within digital transformation, such as Tesco. That could range from food delivery, E-commerce, telehealth, Software-as-a-Service (SaaS), IT service contracts, to Ed-tech. Those sectors are also seeing bulkier marketing and social media budgets, according to a partner at an international tax and advisory services firm.

“Job losses have been mounting, and may only increase as we reach the end of the furlough scheme,” says Parikh in an IoD statement.

Administrative and middle management jobs, even senior ones, will be re-examined by hiring companies that took advantage of the furlough scheme and do not see expect to see a light at the end of the tunnel by October once support comes to an end.

Professional services firms and law firms have only recently started to make job cuts given they were reticent on revealing any such actions until absolutely crucial because they know how hard it will be to re-hire highly skilled talent once the economy starts to see a lift. However, professional services companies and their clients alike will likely be looking for restructuring talent, if they are not already.

UK is not banking on new ways of thinking

The Co-operative Bank today announced plans to close 18 branches and slash around 350 jobs, becoming the latest major UK firm to confirm mass layoffs during the pandemic.

The Co-operative Bank announced today (25 August 2020) proposals to reduce around 350 roles, including the closure of 18 branches. Aside from the specific branches affected, the reduction is expected to focus on middle management positions and head office roles.

The Bank has spoken to affected colleagues and is currently consulting with colleagues and its recognised trades union on the proposals. Where possible, the Bank will look to redeploy colleagues into alternative posts.

“Unfortunately, we’re not immune to the impact of recent events, with the historically low base rate affecting the income of all banks and a period of prolonged economic uncertainty ahead, which means it’s important we reduce costs and have the right-sized operating model in place for the future,” says Co-operative Bank Chief Executive Andrew Bester.

The planned branch closures, which are expected to be completed by 1 December 2020, have been selected following careful analysis of individual branch footfall over a 12-month period [January-December 2019] prior to the start of lockdown. The Bank is writing to affected customers to provide information about the alternative options available to them, including Post Office counter services, telephone, online and mobile banking.

While Bester says that the bank is “responding to the continuing shift of more and more customers choosing to bank online”, traditional brick and mortar banks (and their staff) are not truly grasping the financial opportunity out there, where smaller challenger banks are, but with fewer resources.

Rather than slashing jobs, banks should be at the forefront of creating and acquiring revolutionary ways to transact and borrow online. By using existing employees that have first-hand customer banking dilemmas and experiences combined with specialist contractors to properly devise new ways to serve those customers that want seamless transactions for their personal and even business financial needs, the technology can even be built in-house. This is a new way of thinking rather than the old, which adds up to pointing fingers at lower levels of transactions “in branches”, a trend which Bester claims has been increasing for some time, across the banking sector and more broadly. So, why did they not move with the times while they had the talent on board? The conclusions are countless.

Now what?

Parikh suggests that the Chancellor must respond now with measures to support jobs by cutting the cost of employment, for instance by reducing employers’ National Insurance Contributions.

“By the Autumn, it might be too late to have greatest effect,” he says.

Parikh also says that the Treasury should also “explore options for restructuring business loans, while a targeted grant to help SMEs adjust to the new normal would bolster the Government’s aim of reopening the economy.”

The dilemma for all hiring companies at the moment, small or large, comes down to a few key questions: Can we afford to lose these talented people and what they already know of our business, especially once economic certainty is clearer? Or can we consider offering part-time contractor or consultancy positions to them instead to cut permanent-hire overhead costs, such as paid holiday, sick pay and pension contributions? Do we hire inside or outside IR35?

While the remote-working and social distancing measures may have tilted the working world on its axis, at least for now, one thing remains true and that is office-based professions depend on vibrant economies and vice versa.