Taxation Without Fairness: The Uncomfortable Echoes of the Loan Charge and the Boston Tea Party

OPINION & SPECIAL LOAN CHARGE REPORT

As responses to a Parliamentary debate on the Loan Charge brew this week, we turn to the history books and our American cousins for inspiration on the implementation of a Taxpayer Bill of Rights

- Learn what was inside a Loan Charge Action Group letter to Harriet Baldwin MP and Chair of the Treasury Select Committee in response to a Parliamentary debate. In particular, how HMRC and Treasury Ministers are reportedly “misleading and deceiving MPs and the Committee”, regarding action against promoters of schemes now subject to the Loan Charge.

- There is a call for a US-style Taxpayer Bill of Rights to be initiated in the UK

Many of the UK’s self-employed have experienced fairness and even a sympathetic ear from representatives of Her Majesty’s Revenue & Customs (HMRC). In these cases, the “tax man” may have offered flexible payments known as Time to Pay arrangements or extra support for vulnerable self-employed individuals, such as those with disabilities or caring responsibilities.

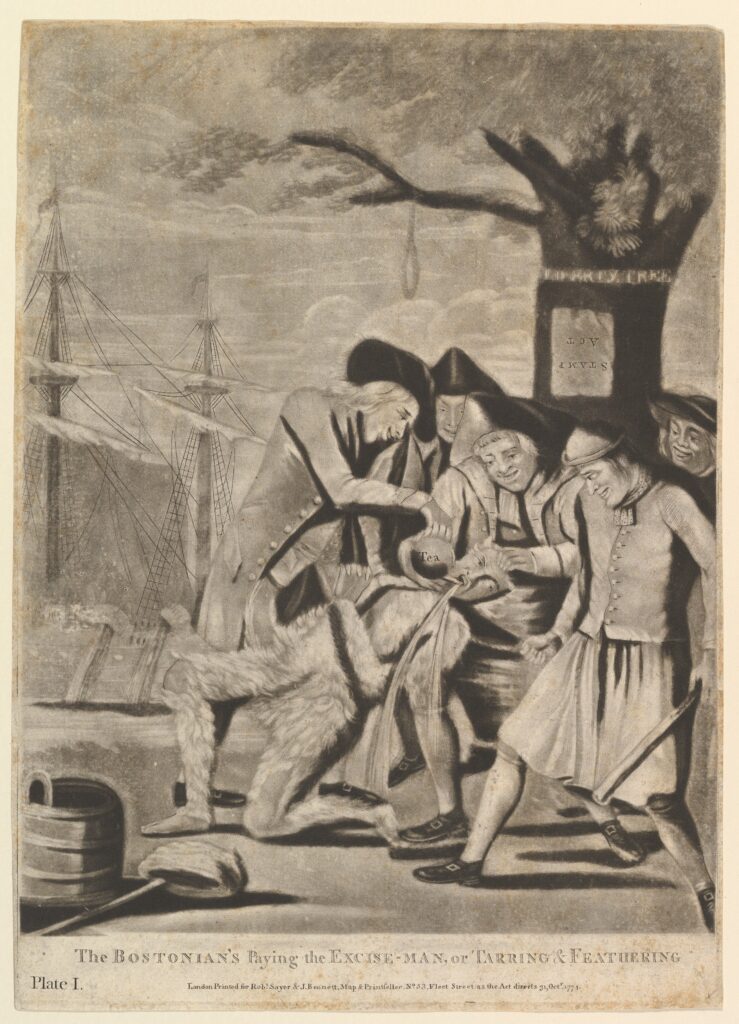

However, tens of thousands of taxpayers would say they have not experienced fairness, a historic parallel reiterated by the spectre of “taxation without representation” which still haunts the halls of power, echoing from the Boston Tea Party of 1773 to the modern-day courtroom.

While the British Parliament of yore may have levied taxes on its American colonies across the Atlantic, a disturbing parallel emerges in the present day with the UK’s loan charge, where the arm of Her Majesty’s Revenue & Customs seems to wield the ominous power of judge, jury, and executioner.

While HMRC deems these schemes illegal, critics argue that retrospective application of the loan charge, with its crippling penalties and draconian enforcement powers, amounts to a modern-day tax on historical grievances.

The American colonists’ cry for fair representation resonated with the fundamental principle that those subject to taxation should have a say in its implementation. The Stamp Act, the Tea Act, and other levies imposed by the British Crown were seen as unjust and discriminatory, lacking the colonists’ consent. This sentiment of unfairness fueled the flames of rebellion, leading to what colonists believed to be the birth of a nation built upon the bedrock of equitable taxation.

Fast forward to the 21st century, and the loan charge casts a long shadow of similar concerns. This controversial tax scheme targets individuals who used disguised remuneration schemes (DRSs) years ago, often under the advice of financial professionals. While HMRC deems these schemes illegal, critics argue that retrospective application of the loan charge, with its crippling penalties and draconian enforcement powers, amounts to a modern-day tax on historical grievances.

The burden of proof rests on the individual, often burdened by years of complex financial records and potentially misleading advice from their former advisors. This lack of independent scrutiny creates an environment ripe for abuse and potential miscarriages of justice.

The unsettling parallel lies in the lack of due process and independent oversight inherent in the loan charge. HMRC assumes the role of accuser, judge, and debt collector, leaving taxpayers feeling trapped in a Kafkaesque nightmare. The burden of proof rests on the individual, often burdened by years of complex financial records and potentially misleading advice from their former advisors. This lack of independent scrutiny arguably creates an environment ripe for abuse and potential miscarriages of justice.

The consequences of the loan charge are dire. Many individuals face financial ruin, forced to sell homes and businesses to appease the taxman. The psychological toll is equally devastating, with reports of anxiety, depression, and even suicides linked to the pressure of this punitive tax.

The echoes of the American Revolution remind us of the importance of a fair and equitable tax system. Just as the colonists demanded representation, taxpayers today deserve a transparent, accountable system that protects their fundamental rights. The loan charge, in its current form, stands in stark contrast to these principles.

The solution lies in reform

An independent review of the loan charge, with a focus on due process and individual circumstances, is paramount. Some feel the burden of proof should shift to HMRC, and access to affordable legal representation should be guaranteed. However, those impacted by the Loan Charge have lost trust in the British legal system. Ultimately, everyone wants a system that must uphold the fundamental principle of fairness in taxation, ensuring that the ghosts of “taxation without representation” remain firmly in the past.

The American Revolution may be a distant memory, but its lessons on fair taxation and due process remain as relevant as ever. The loan charge presents a stark reminder of the dangers of unchecked power and the importance of a system that protects the rights of all taxpayers. By acknowledging the uncomfortable parallels and implementing meaningful reforms, we can ensure that the cry for justice echoes not in the courts, but in the halls of a truly equitable tax system.

Parliamentary debate on the Loan Charge: what it revealed

On the 18th of January 2024, a debate was carried out in Parliament on the Loan Charge – a punitive retrospective tax by HMRC that has affected tens of thousands of innocent people and has led to 10 suicides.

The Loan Charge was pushed through Parliament by then Financial Secretary to the Treasury Mel Stride MP, who according to contractor and IR35 specialist Dave Chaplin, broke through traditional statutory safeguards that would normally protect taxpayers. It’s estimated more than 50,000 people are affected, making it 100 times worse in terms of people affected, than the Post Office Scandal.

The Loan Charge has considerable parallels with the Post Office Scandal, such as abuse of power by state bodies, combined with weak ministerial oversight, and what Chaplin expresses as “state bullying of thousands of innocent people.”

During the debate, Greg Smith MP said, “There does need to be serious action taken on how you can have bodies in the case of the Horizon scandal the Post Office, in the case of the Loan Charge Scandal, HMRC, where a body of the state is autonomous in being Judge, Jury and Executioner at the same time. That is something that we simply have to take away, and there have to be the checks and balances built into HMRC.”

The letter that questions HMRC’s handling of the loan charge

The Loan Charge Action Group wrote a letter to Harriet Baldwin MP and Chair of the Treasury Select Committee this week that in this Parliamentary debate and in previous instances, there have been “deliberate attempts by HMRC (and Treasury Ministers) to mislead and deceive MPs and the Committee, regarding action against promoters of schemes now subject to the Loan Charge.”

The Loan Charge and Taxpayer Fairness APPG has also since written to Mr Harra on this on the

5th December 2023.

At the evidence session, Treasury Select Committee member Danny Kruger MP, according to the LCAG letter, challenged Jim Harra, First PermanentSecretary and Chief Executive of HMRC, over whether HMRC had pursued the promoters for promoting the schemes now subject to the Loan Charge.

“As usual, HMRC failed to give clear answers and in one case sought to mislead the Committee,

which has been a feature of the whole Loan Charge Scandal (and something that the Loan Charge

and Taxpayer Fairness APPG has said should be properly investigated),” according to the letter.

In response to Danny Kruger’s line of questioning, about whether HMRC has pursued those who

promoted the schemes that are now subject to the Loan Charge, Jim Harra responded by

mentioning convictions of promoters of tax avoidance schemes.

According to the letter, “This is something that HMRC and the Treasury have done repeatedly when questioned on what action has or has not been taken with regard to those who promoted the schemes now subject to the Loan Charge.

Mr. Harra told the Committee:

I believe that in recent years we have successfully prosecuted or convicted about 20

promoters of tax avoidance schemes, which will cover the full range of marketed schemes.

But nowadays, about 90% of all marketed avoidance is in employment taxes such as

disguised remuneration.

This seems to be a “deliberately misleading answer,” according to Loan Charge Action Group executive directors Steve Packham and Andrew Earnshaw.

Their argument is “Mr. Harra will know that none of the convictions he refers to are related at all to the promotion of schemes now subject to the Loan Charge or what HMRC calls ‘disguised remuneration’.”

According to the letter, the “same misleading information” has been given out in both letters and in answers to Parliamentary questions on the Loan Charge, stating:

“Since 2016, more than 20 individuals have been convicted for offences relating to tax

evasion or fraud where arrangements have been promoted and marketed as tax avoidance.

These have resulted in over 100 years of custodial sentences being ordered and 9 years of

suspended sentences”.

HMRC has been asked, including via Freedom of Information requests, to give information

about these oft-quoted convictions and whether any are for promoting the schemes subject to

the Loan Charge.

It is argued that none of these convictions has anything at all to do with the Loan Charge,

with the promotion of schemes now subject to the Loan Charge (or what HMRC calls

‘disguised remuneration’).

The letter stated:

All these criminal convictions are for either fraud or tax evasion, none of them are to do with schemes subject to the Loan Charge or anything remotely similar. To refer to them when asked directly about what action has been taken against those who promoted the schemes subject to the Loan Charge is therefore deliberately deceitful and is dishonest.

“This information shows that Jim Harra misled the Committee on 18th October 2023 by giving the

false impression that somehow these convictions were linked to promoters of the schemes

subject to the Loan Charge and Danny Kruger’s line of questioning (which was clear and

explicit),” according to the letter to MP Harriet Baldwin.

Get news and views impacting the world’s freelancers every week

Sign up for our newsletter via this link:

Be informed, be Freelancer Informed! | Freelance Informer

Taxpayers Fairness Campaign

Dave Chaplin, who is also Chair of the Taxpayers Fairness Campaign, which is aiming to achieve greater fairness for taxpayers via legislative reform of HMRC, says urgent Parliamentary intervention is needed:

“Fairness heavily depends on a transparent and accountable tax administration built upon statutory processes and independent oversight,” says Chaplin.

He continues, “The UK does not have that, and what we are witnessing is a ‘bad policing’ problem by HMRC who have the powers of judge, jury and executioner.

“HMRC has already reduced staff numbers but hasn’t made enforcement and compliance any easier, leading to questionable methods to hit tax revenue targets, which have departed from the principles of fairness.”

Following the US role of fair taxation

Chaplin believes the UK Parliament can solve this problem using tried and tested mechanisms enacted by the US Congress, which confronted similar unfairness problems in the 1990s, leading to a Taxpayer Bill of Rights supported by Taxpayers Rights Code, and overseen by a powerful Taxpayer Advocate to ensure legislated procedures were followed.

“The US laws offer a perfect model/template for the UK Parliament, and we urgently need them,” he says.

He believes a Taxpayer Bill of Rights would provide legislative measures, “maximising fair dispute resolution, reducing the pressure on the appellate courts, and lower collection by intimidation by curtailing abuses of power, focusing on collecting the correct amount of tax.”

Also commenting on the debate, Crawford Temple, CEO of Professional Passport, the UK’s largest independent assessor of payment intermediary compliance said:

“Sammy Wilson MP must be applauded for securing today’s debate. HMRC has been negligent and failed the victims caught up in the loan charge. The whole scandal could have been avoided and lives protected if HMRC had used the intelligence it holds to identify the architects of the schemes and taken hard action and shut them down.

“Instead, HMRC pursued the victims and as a result, lives have been lost and livelihoods have been ruined. It is shameful. Non-compliance in the supply chain has gathered pace over the years and workers have suffered the consequences and are still suffering.”

Temple relayed that Nigel Huddleston, Financial Secretary to the Treasury, had expressed that tackling tax avoidance has been a priority for the government, however, he suggests otherwise and “that it is lacking, is too slow and just not effective enough.”

Temple says a lot of the answers are in the data:

“HMRC must work more closely with the recognised compliance bodies to raise standards and by working together and tapping into the data available only then will we be assured of stamping out non-compliance and limiting the access to market for criminals to do business.”

Have you read? …

25 Reasons why HMRC could use AI for umbrella company background checks – Freelance Informer

Echoes of Injustice: Parallels between the Post Office Scandal and IR35 – Freelance Informer