Tax non-compliance in the umbrella market: isn’t it time the masquerade party came to an end?

The umbrella market has been a hotbed for tax non-compliance, with unsuspecting temps and contractors falling foul of tax avoidance schemes every year. A new report assesses the damage to workers and the umbrella companies that are compliant yet must work in a tarnished industry that the government has opted to not regulate for far too long.

HMRC has acknowledged that 99% of the tax avoidance market involves disguised remuneration schemes targeting contractors and agency workers, and these schemes often masquerade as compliant umbrella companies. However, HMRC has consistently failed to tackle these companies, instead targeting umbrella workers with life-changing tax bills.

Neither HMRC nor the ONS has a firm idea of the number of people working through umbrella companies who might be at risk of being lured into a tax scheme. This is a concern given the increase in umbrella workers following the off-payroll reforms.

To better understand the umbrella sector, PayePass, a compliance software and service company, commissioned evidence-based research. The findings revealed that the umbrella sector is large and diverse, with a wide range of workers using it, including those in the gig economy, those looking for flexible working arrangements, and those who have been laid off from permanent jobs.

The research also found that the umbrella sector is facing a number of challenges, including:

- Tax non-compliance: Some umbrella companies are not paying the correct amount of tax and NICs on behalf of their workers. This can put workers at risk of being hit with large tax bills.

- Low pay and benefits: Umbrella workers often receive lower pay and benefits than permanent workers.

- Lack of transparency: It can be difficult for workers to compare different umbrella companies and to understand the fees they are being charged.

The research concludes that there is a need for more regulation of the umbrella sector to protect workers and to ensure that all umbrella

However, it is now possible to prove the tax compliance of any umbrella company, so this risk is easily manageable. That is according to Julia Kermode, CEO of PayePass, who has conducted a report called Shifting Sands.

What is the government’s next move?

Kermode and many umbrella workers are calling for the government to regulate the umbrella sector to protect workers and ensure that all umbrella companies are paying the correct amount of tax. This regulation should include a requirement for the supply chain to conduct robust due diligence on the umbrellas that they work with.

The umbrella industry also needs to do a better job of proving its compliance. This is in everyone’s best interests, as continued false claims of compliance will only exacerbate mistrust of the sector and could ultimately lead to its demise.

The government has recently issued a consultation with options on how to deal with non-compliance in the umbrella market. One option is to transfer debt to recruitment agencies (and possibly end-clients), making them liable for unpaid tax and NICs arising from an umbrella being non-compliant and going into liquidation.

A new era of compliance

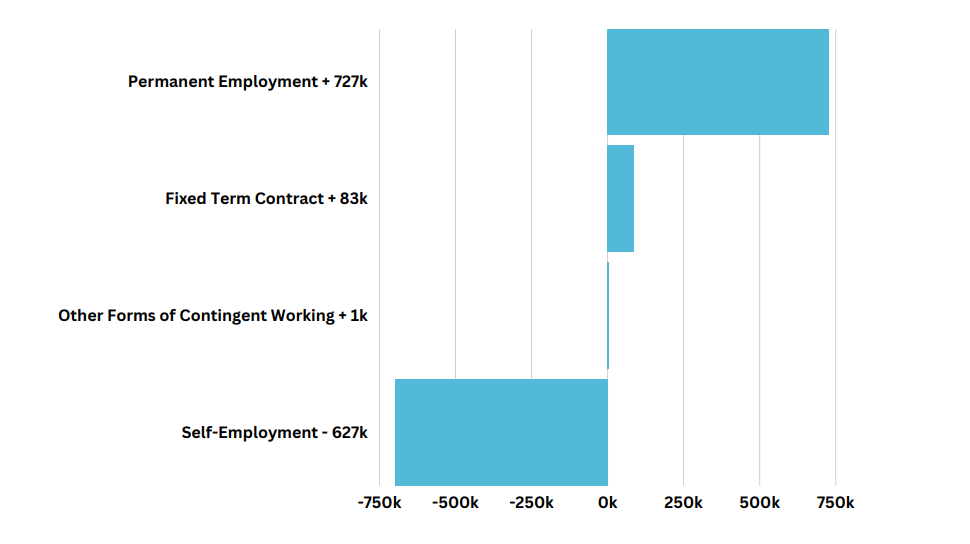

The umbrella industry has been poorly perceived in recent years, according to the report, with many people believing that it is rife with tax avoidance and other malpractice. This perception has been exacerbated by the off-payroll reforms, which have forced many self-employed people to work through umbrella companies.

However, Kermode is of the opinion that the umbrella industry is large and diverse, with many umbrellas providing a valid, compliant, and professional service to both workers and the recruitment sector. However, there is a minority of large umbrella companies that have been able to profit from the off-payroll reforms by paying commissions to recruitment agencies in exchange for business. This practice is unsustainable for compliant umbrellas and is driving down margins.

Related articles

Apprentice Levy Loophole Smacks Of Injustice For Umbrella Company Workers And Contractors