Report reveals property markets at “bubble risk”

Freelancers and digital nomads who rent, are mortgage holders or property investors must keep on top of global property prices should they want greater financial freedom. See which cities are most at risk of a bubble and which ones are still priced fairly

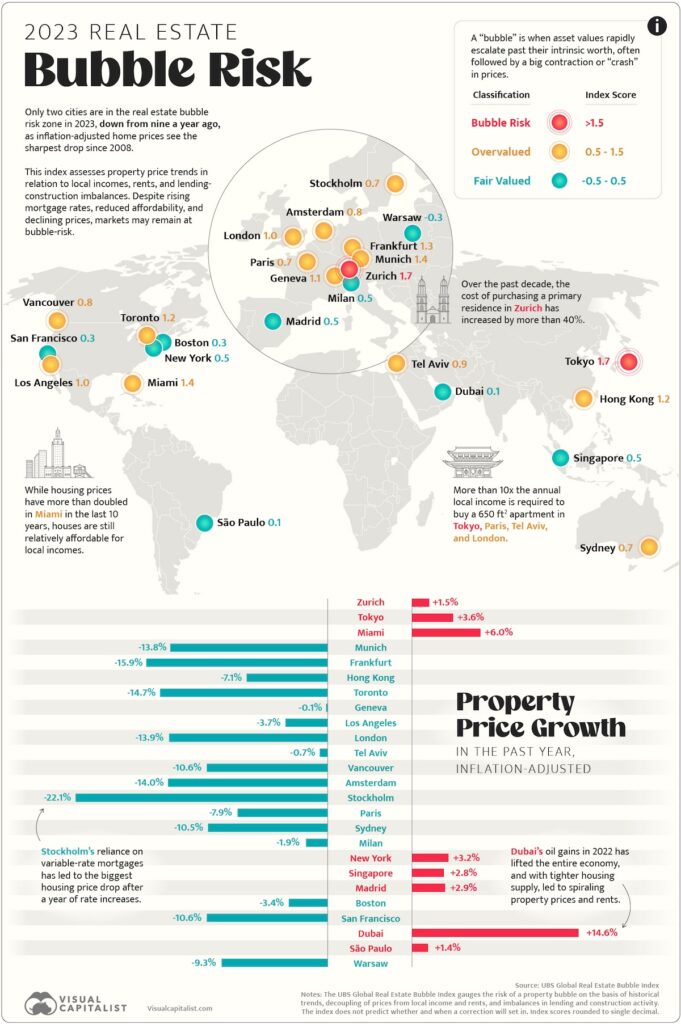

Two cities, Zurich and Tokyo, are currently at risk of a real estate bubble, according to a new report from UBS. The report, which assesses a variety of factors including price-to-income ratios, credit growth, and construction activity, found that these two cities have the highest risk of a bubble forming.

Zurich, Switzerland’s financial capital, has seen real home prices rise by 10% annually on average since 2016, the highest rate of all cities evaluated. Tokyo has also seen significant price increases in recent years, with prices now over 80% higher than they were in 2012.

Other cities that are at risk of a bubble include Miami, Florida, and Munich, Germany. These cities have seen rapid price increases in recent years, and they both have high price-to-income ratios. However, the report indicates that Miami property prices are in line with local salaries.

While property prices have cooled in most of the analysed real estate markets, the rental market in many cities, such as Vancouver and Toronto, has rapidly moved in the opposite direction. Landlords are passing on higher mortgage costs to renters, which is something digital nomads looking to move abroad must take into account.

The report also said that Dubai’s property prices are growing in the double digits as a result of an “economic boom from oil prices” and increased immigration by wealthy individuals.

See how cities rank for bubble risk in this infographic by Visual Capitalist:

What are the inherited risks?

The report warns that a real estate bubble can have a number of negative consequences, including a sharp decline in prices, a rise in foreclosures, and a credit crunch. It is important to note that the report does not say that a bubble is inevitable in Zurich and Tokyo, but it does highlight the risks that are present in these markets.

Homebuyers and investors in these cities who are considering a move to them should be aware of the risks before making any decisions.

Here are some tips for home buyers and investors in cities that are at risk of a real estate bubble:

- Do your research: Before you buy a home or invest in real estate, it is important to do your research and understand the market. You should look at price trends in certain areas, inventory levels, and economic conditions.

- Consider your financial situation: It is important to make sure that you can afford to buy a home or invest in real estate, even if prices fall. You should also have a plan in place in case you need to sell your home or invest in a property quickly.

- Be patient: If you are buying a home or investing in real estate, it is important to be patient. It may take time to find the right property and to get a good deal when interest rates go down.

It is also important to note that the report is only a snapshot of the current market conditions. The risk of a real estate bubble can change quickly, so it is important to stay informed about the latest developments.