No cushion for impact: how the Chancellor’s budget outlook ignored the imminent cost of living crisis

OPINION

The Autumn Budget could be seen as no news is good news for the UK’s 4.3 million freelancers and self-employed businesses. Thing is, the Chancellor and the Tory government had already delivered a series of bad news in the preceding weeks. What the Autumn Budget failed to address was a looming crisis that will impact all of us, Katherine Steiner-Dicks reports.

“There are two ways to view this Budget,” according to Qdos CEO, Seb Maley. “On one hand, it’s a relief there are no major tax changes affecting the self-employed. On the other, many will feel the damage has already been done.”

Maley said it will be the recently announced social care levy, corporation tax changes in 2023 and IR35 reform that will hit freelancers, contractors and small business owners hardest. And the cut to business rates, while welcome, won’t be felt by those who work remotely and don’t want or need premises.

“In his speech, the Chancellor was self-congratulatory about the government’s treatment of entrepreneurs. This is now a tired out, unconvincing rhetoric and one that’s falling on deaf ears,” said the IR35 insurance specialist.

Maley found very little to celebrate in this budget, expressing that sparing the self-employed for now does not “paper over the cracks for the self-employed”.

“These workers are bearing the brunt of short-sighted, quick-fix tax reforms that endanger this vital cog of the economy, rather than support it,” he said.

Freelancers respond to the Budget

Amy Baker, owner of Wisbech area mobile beauty salon, Halo Beauty and Holistic Therapy, said that the Chancellor continues to overlook remote self-employed workers.

“So the leisure, hospitality and retail sectors get a 50% discount in business rates, but what about some help for the Hair and Beauty industry that is still plagued by Covid with last-minute cancellations and no shows? Especially for the mobile therapists who received absolutely no help at all. Rishi says we have a few tough months ahead but it feels more like a few years for those in my industry.”

Amy Baker of Halo Beauty and Holistic Therapy

“From most people’s perspective, it really was a nothing budget. No major changes to income or CGT rates, pensions nor an inheritance tax,” said Dam Walkom, co-founder of Permanent Wealth Partners.

“The Chancellor teased about major reforms on business rates then proceeded to announce more regular valuation adjustments and just temporary relief for the hospitality sector — hardly large-scale structural changes.

“When the major tax announcements are on the smallest of taxes such as tonnage tax and domestic air passenger duty, this shows how much the Chancellor was scratching around the edges of tax reform. The benefits for pubs and hospitality is good to hear, but that really is just small beer compared to the opportunity there was to reform business rates properly,” said Walkom.

Scott Gallacher, Director at wealth management firm, Rowley Turton, said the budget brought some positive news to higher earners.

“The devil is always in the detail but higher earners should be delighted that pensions tax relief seems to have been left alone. I’m also happy that the Chancellor is finally correcting the injustice of lower-paid employers in ‘net pay’ pensions schemes not receiving tax relief.” Gallacher.

Scott Gallacher, Director at Rowley Turton

Inflation: it’s coming

Inflation could eat up many solopreneurs’ bank balances in the coming weeks if they do not act now to get their finances in order by locking in low-interest-rate deals on mortgages, credit cards and energy packages. The Bank of England is already assuming an inflation rate of 5.2% by December.

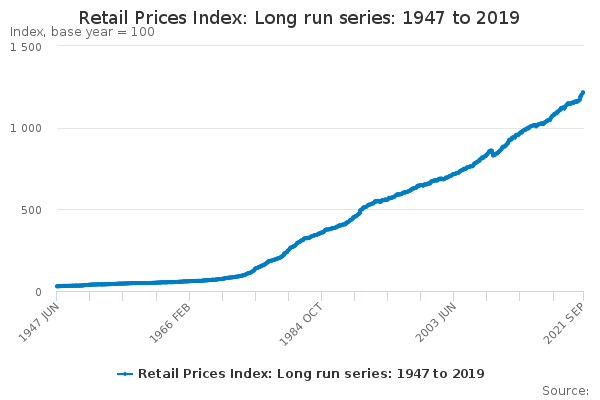

To put this into perspective, a good or service costing £10 in 1950 would in today’s money cost £350.42. The central bank may have no choice but to raise interest rates to come in line with inflation, which means anyone on a flexible mortgage will be paying more.

The suspension of the pension triple lock will save the Treasury £5.4bn in the 2022-23 tax year, rising to £6.7bn by the end of the five year spending period, according to OBR forecasts. That means over that five years this will cost retirees £2,460 in lost pension income.

The triple lock ensures the state pension rises each year by the highest of inflation, wage growth or 2.5pc, explains The Telegraph.

“However, Chancellor Rishi Sunak has reaffirmed plans to break the Conservative manifesto promise by dismantling the triple lock as part of the Autumn spending review. The state pension will increase by 3.1pc rather than 8.3pc due to the suspension of the earnings link,” said the news report.

Derek Cribb, CEO of IPSE (the Association of Independent Professionals and the Self-Employed), was also hoping for some glimmer of acknowledgement to the contribution that small businesses have on the future growth of the UK economy.

“Overall, this Budget does nothing to reassure the UK’s 4.3 million self-employed businesses, who are reeling from a series of setbacks, from gaps in support to disastrous IR35 reforms,” said Cribb.

Cribb said that while IPSE is grateful there were no new tax rises, colleagues and members were disappointed the Chancellor didn’t take the opportunity to further simplify and reduce working taxes.

“Instead, we had a promise that tax would come down by the end of the Parliament but no indication of exactly how,” said Cribb.

Cost of living: are we on the edge of a crisis?

Freelance and contractor households are likely to feel the squeeze of higher inflation and will be feeling the pain, not by any new announcements in the Autumn Budget, but by previously announced policies and the possibility of an interest rate hike.

The biggest new policy was the cut in the rate at which benefits are taken away when recipients earnings increase (the ‘taper rate’) from 63% back to 55%, which was the original level in the UC system in the early 2010s, highlights The Institute for Government.

“This move is a sensible one but does not reverse the impacts of ending the £20 uplift. The new policy costs around £2 billion per year, about one-third of the cost of making the uplift permanent, and only helps those who are in work,” said Dr Gemma Tetlow of the Institute.

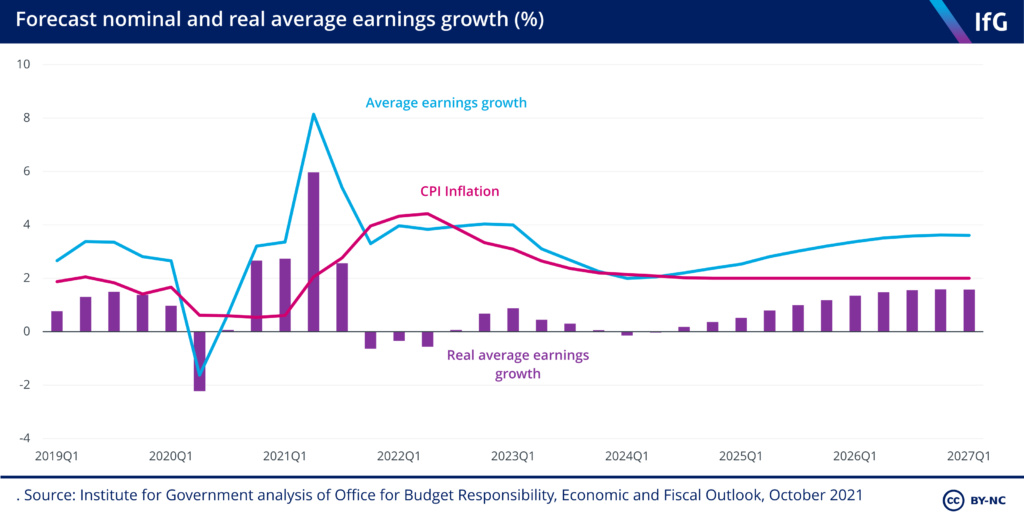

The OBR expects earnings to grow less quickly than prices over the next year or so, and only really start to keep pace with inflation once it returns to its target.

The Institute noted that the Budget announced no big policies to ease rising costs of living. Fuel duty was – inevitably – frozen in cash terms for the 12th consecutive year, and alcohol duty was cut on some drinks: frequent drinkers of draught beer and rosé wine may notice a small benefit. The minimum wage will also be increased in line with the recommendations of the Low Pay Commission.

“The pain for households will be compounded by policies the chancellor has previously announced – such as the health and social care levy and the end of the temporary £20 per week Universal Credit (UC) uplift. The freeze to the income tax personal allowance and higher-rate threshold from next April will also now bite harder because those thresholds would otherwise have increased by inflation,” said Tetlow.

Overall, then, Tutlow and her colleagues believe that the short-term message from the budget is that household incomes are likely to be squeezed over the next couple of years – and unless you are an earner on UC or a minimum wage worker, there is not much that the chancellor has announced to cushion the impact.

National Living Wage is raised

The rise, which will come into effect next spring, will mean that the country’s lowest paid workers will receive an extra £1,000 a year.

These rates are for the National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school leaving age). The rates change on 1 April every year.

| National Living Wage | 23 and over | 21 to 22 | 18 to 20 | Under 18 | Apprentice |

|---|---|---|---|---|---|

| April 2021 (current rate) | £8.91 | £8.36 | £6.56 | £4.62 | £4.30 |

| April 2022 | £9.50 | £9.18 | £6.83 | £4.81 | £4.81 |

An apprentice aged 21 in the first year of their apprenticeship is entitled to a minimum hourly rate of £4.30.

Apprentices are entitled to the minimum wage for their age if they both:

- are aged 19 or over

- have completed the first year of their apprenticeship

For example, an apprentice aged 21 who has completed the first year of their apprenticeship is entitled to a minimum hourly rate of £8.36.

Richard Eagling, senior personal finance editor at NerdWallet, said: “Any move to increase the wages of society’s vulnerable employees should be applauded. Raising the National Living Wage by 6.6%, teamed with the tapering down of universal credit rates will certainly help to ease the financial anxiety of lower-income households.

That said, the Government could have gone further to ease the financial burden placed on many households throughout the pandemic, particularly within the context of rising inflation. For example, offering a VAT cut – even a small one – to household energy bills would offer some much-needed financial breathing space, he suggested.

“Now, the Government must see how they can offer further support to households – ensuring they know where to look for help with financial management or debt advice, for example. Doing so would be a positive step in helping Britons to regain control of their finances,” said Eagling.

State pensions will see a boost, but at what cost to younger generations?

The state pension will rise by 3.1% in the 2022-23 tax year, equating to an annual boost of £289 for some pensioners.

Andrew Megson, executive chairman of My Pension Expert said: “Given the volatility experienced by savers throughout 2021, the Government was right not to introduce any major pension policy changes. So too was promising offering greater protections for workplace pension savers from higher scheme charges. However, the pension system is far from fixed – nearly 2.1 million UK pensioners are currently living in pension poverty. Mr Sunak can’t afford to be complacent.”

Megson said that the Government must ensure savers have the necessary tools to effectively plan for retirement.

“Given the amount of disruption savers have faced in 2021 – the temporary pausing of the state pension triple lock, and uncertainty surrounding pension age increases, to name a few examples – guidance simply won’t do. People need access to independent financial advice.

“I want to see the Government reaching out to regulatory and advisory bodies to achieve this. Without a cross-sector effort, we could see future generations of retirees facing disastrous financial consequences,” said Megson.

Articles you may find useful:

Why freelancers should negotiate everything right now – Freelance Informer

IR35: it’s driven 35% of contractors out of self-employment – Freelance Informer

Autumn Budget: Will Rishi come through for Freelancers? – Freelance Informer

NI tax hikes: Will umbrella contractors get the chop? – Freelance Informer

HMRC handed new powers to Clampdown on promoters of tax avoidance schemes – Freelance Informer