Being self-employed is often a personal choice led by personal circumstances or an innate entrepreneurial drive to carve out your own career and destiny – you do what you love. But in the month leading to April 2021, many freelancers and agency contractors will be questioning whether they will be truly freelance or have to become part of an umbrella company scheme, and they will have to wait for their hiring company client to determine that. If your client is small, then you determine and verify your status.

A new report highlights that recruitment agencies should already be able to provide their contractors with an educated guess on which clients are freelancer friendly and which are likely to make a blanket ban on off-payroll workers, regardless if they may be inside our outside the IR35.

Kingsbridge, the Contract worker insurer, has reported in its 2020 IR35 Survey Report, that 49% of the 143 recruiter respondents had originally begun preparing six months ahead of the earlier intended roll-out date of April 2020 and just over 40% had begun preparing 12 months out, which indicates that your agency should already have a very good idea of where your IR35 status stands with their clients.

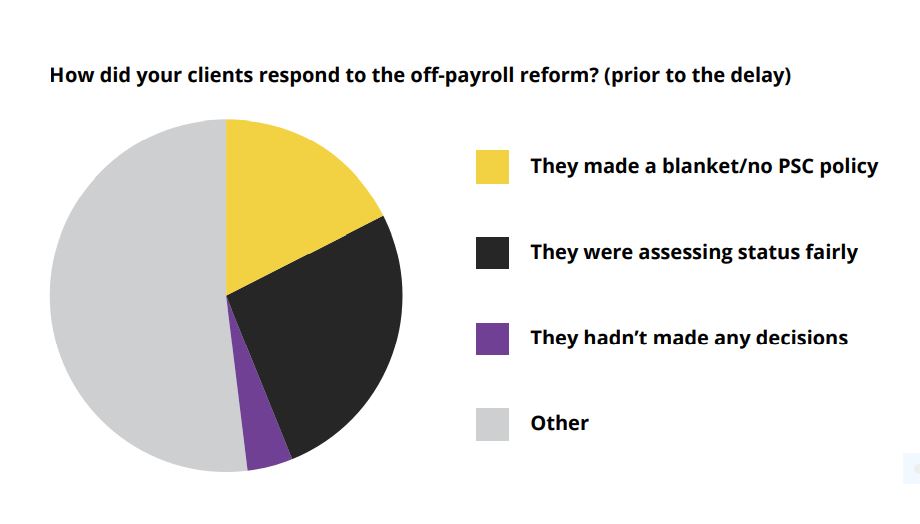

However, not all clients are assessing fairly, said the report. When respondents in the survey were asked how their clients had reacted to the IR35 reform prior to the April 2020 delay, only a quarter (26%) said that their clients were assessing status fairly, with 18% reporting that their clients had imposed a blanket ban on PSC contractors. Over half (52%) fell into the ‘other’ category, where the majority specified that they had seen a mix of blanket PSC bans approaches, fair assessments and no decisions being made.

It is also worth noting that despite the initial barriers that many recruitment firms flagged as a challenge, 73% felt very prepared as a recruiter and 89% of those surveyed reported that they had some level of influence over their clients’ IR35 strategy. This suggests that in many cases, recruiters were already beginning to make headway in terms of educating clients as to the determinations required and how the reform could be approached in an intelligent way that minimised disruption and unnecessary cost.

“Some of our clients made a genuine effort to assess status fairly and were working with us to find a strategy that would work for all parties. However, some clients put a blanket/no PSC policy in place because they believe that is the easiest way to deal with this legislation which is a shame.”

Survey Respondent

Kingsbridge said blanket bans are “unnecessary and unfair” at a time when there are already widely reported skill shortages in professional sectors such as technology and engineering. Consequently, so imposing such bans has the potential to restrict the use of contractors, disrupt the UK’s talent ecosystem and, as a result, restrict the recovery and growth of the UK economy. However, despite this some large end-clients elected to go down this route as providing the “safest” option.

Where blanket ban approaches had been implemented, numerous respondents cited a trend in larger companies choosing this route versus smaller and medium-sized companies who were willing to take

a more tailored approach. This is perhaps indicative of the greater number of contract professionals likely to be used by big brands, though some respondents suggested that once a few big companies took a “no PSC approach”, others simply followed suit: “Big clients followed each other with blanket approaches.”

Where fair assessments were being made, said Kingsbridge, there was still some concern that these were overly cautious, with one participant stating: “Most were assessing fairly, albeit falling heavily on the prudent side so most were resulting in inside determinations.”

According to Tania Bowers, Legal Counsel at APSCo, the imposition of blanket bans was mainly due to the fact that very large end-clients simply didn’t know the scale and scope of the contracts they had with PSCs, so had little choice.

“That meant that they couldn’t make status determinations in the time frame allowed. The delay means that this isn’t now a problem and I hope that they will use this time to properly evaluate their contract book.”

It does seem as though the delay has rather encouragingly led to a rethink on this matter.

Participants reported that over a third of clients (35%) were making a U-turn on non-PSC decisions. However, Bowers does add a note of caution. “The problem is that businesses have bigger fish to fry – an economic crisis, a health crisis and Brexit coming down the road – as we get closer to the deadline, they may just take the path of least resistance.”

Kingsbridge Managing Director Thomas Wynne has a positive outlook and expects most contractors to remain outside IR35, despite HMRC’s estimations.

“It is important to remember that even when using HMRC’s own statistics, the vast majority of PSC contractors are, and will remain, genuinely self-employed and therefore “outside” IR35 following the planned reforms.”

Kingsbridge Managing Director, Thomas Wynne

What changes is that the responsibility for determining IR35 status will pass from the individual contractor to the end-client and the tax liability, should that determination later be shown to be wrong, will fall to the fee-payer, which in most cases will be the recruitment firm.

“Contingent labour will likely to play an even bigger role in the UK economy over the coming few years as companies seek flexible resources in an uncertain market,” he said.