Time is of the essence to get the most out of your pension and savings tax relief for the 2020/21 tax year, especially with chatter that Chancellor Sunak may increase Capital Gains Tax. For company owners and directors in the process of retiring or selling their business, any hike in capital gains tax could seriously put a dent in your ability to fund your next venture or retirement plans.

Path to pension poverty – why are so many on it?

Many of the UK’s self-employed do not want to admit it, but they are on the path to pension poverty. Why? They are not investing in a private or personal pension, using their tax-free Stocks and Shares ISA allowance, or investing in a Self-Invested Personal Pension (SIPP). According to financial advisors and accountants, they are throwing away good money because they do not use the tax relief provided to them by the government or through their own company pension contributions.

State of mind: are state pensions enough?

Would you be able to live comfortably on £9,110 a year? This is the amount you will be expected to live on if you have only a state pension to rely on in retirement. Economists do not believe this amount can maintain a comfortable standard of living in Britain.

Unless they are self-sufficient that is, for: housing, food and beverage, power and heating, health, leisure, clothing, transport, insurance, and the odd emergency. Not to forget council tax. For a better understanding of Benefits and Entitlements check out the Age UK website to see what current policies are based on ability to pay in your retirement years.

However, for the majority of self-employed workers and limited company directors, leading The Good Life is better left for TV sitcom entertainment, despite how admirable self-sufficiency sounds. This is where shopping around for financial products that will help you meet your goals comes in.

What pension choices do I have?

Self-employed workers can take advantage of pension contributions tax relief. There are three types of personal pensions to choose from (learn more from the Money Advice Service):

- Ordinary personal pensions – which are offered by most large providers

- Stakeholder pensions – where the maximum charge is capped at 1.5% and you can stop and start premiums without penalty, and

- Self-invested personal pensions (SIPPS) which have a wider range of investment options, but usually higher charges. Those interested in investing in commercial property either for your own business or another may consider a SIPP. Many in the farming community or those considering farm shops or rented commercial office space on their land turn to a SIPP as one of their pension options. Perhaps in addition to a personal/private pension.

SIPPs may cost you more, but they can be tax-efficient for certain types of investment (i.e. commercial property). Therefore, if you are only just starting to invest in a private or personal pension, may want to consider a SIPP at a later date once you get your feet wet and set out your short, medium and long-term business and retirement plans ( and life’s hiccups along the way).

What is the annual pension tax relief allowance?

While you can put as much away as you like towards your pension, there is a limit to how much of that amount will receive tax relief. This is considered your annual allowance. You can be eligible for tax relief until you are age 75.

The annual allowance for 2020-21 is £40,000 (or 100% of your earnings for the year if less). If you go over £40,000, you will not get tax relief on further pension savings.

According to the Money Advice Service, you can usually carry forward unused annual allowance from the previous three years. You can find out more in the following links about Personal pensions, Stakeholder pensions and Self-invested personal pensions (SIPPs).

No CGT on ISAs or pensions – preserve your savings

There is no capital gains tax payable on shares or units held in an Isa or pension. For all other shares, you will pay capital gains tax on any profits from a sale, that is why if you have holdings in shares that are not held in a tax-free ISA, then you should consider selling up before any CGT hikes in the 2021 tax year.

Any proceeds you receive from the sale (less CGT) could then be placed in a tax-efficient ISA or through your existing pension fund or a new one. Perhaps in a fund with a complimentary risk level to balance out your portfolio.

Currently, higher or additional rate taxpayers pay 28% on gains when selling a second home or investment property, and 20% when selling a business, antiques, jewellery, or shares held outside of an ISA. This applies to individual stocks and collective vehicles such as investment funds, investment trusts, and exchange-traded funds. Basic rate taxpayers pay capital gains tax at lower rates of 18% and 10%, respectively.

How much more will I pay if CGT increases ?

Capital gains rates could be brought into line with income tax, which would see higher-rate taxpayers charged 40% and additional rate taxpayers 45%, regardless of the asset class, according to a Motley Fool report. “If that happens, the capital gains tax rate they would pay when selling non-ISA shares would more than double from today’s 20%,” said the report.

For the latest updates on CGT and other financial products geared for the self-employed and contractor workforce, sign up to our newsletter below:

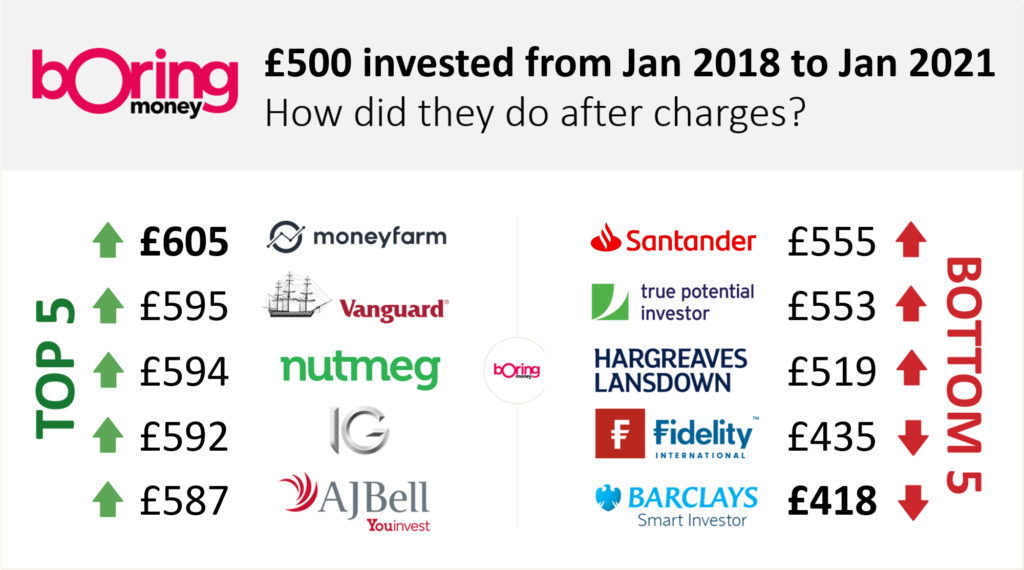

What will a personal pension cost me in fees?

Depending on your financial acumen or ability to keep updated on pension regulations and tax and stock price fluctuations within a diverse portfolio, you have the choice to sign up to a pension plan with or without financial advice. Without advice, all questions must be answered through your own research and time management of your portfolio of investments- stocks, shares, savings, etc.

If you are not already contributing your pension through your company, then learn of the tax relief of doing so here for some initial guidance. This is ‘free money’ as they say. There is a difference between sole traders and limited company director/owners when it comes to tax relief, so be sure to ask an accountant for more details.

Financial advisors charge fees. That is why it is important to understand those advisor fees could be added on top of paying a monthly fee on your monthly pension contributions when going through a private pension to SIPP. That could be a decent chunk of change depending on the rate, product and the advisor. For example, you could easily pay 3.5% of your pension pot a year in fees to a financial advisor if they are managing and advising your private pension. Some pension fund advisors, however, cull fees after five years or have more competitive rates or even flat annual fees. That is why you must shop around.

Advisors should ask you about your retirement goals, current revenues, savings, and life’s big events you hope to fund (i.e. university fees, weddings, company expansion plans, etc.) plus answer any questions you have when it comes to tax relief, etc.

According to a report by the International Longevity Centre UK (ILC), Financial advice not only pays for itself but boosts confidence and preparedness for retirement:

- People who take financial advice are, on average, £47,000 better off in retirement than people who don’t – and this is especially true for less affluent groups.

- People who receive advice are also more confident, worry less and are better prepared for retirement than those who don’t take advice.

- However, a significant advice gap remains, with less than 1 in 6 people in the UK currently taking advice.

Some financial advisors are tied to products, others are independent. Therefore, you have to not only have confidence in the advisor but the products they are pitching or selling to you.

Questions to ask an advisor:

- May I have a copy of the five-year performance reports of all the funds that I am interested in? Ask what you don’t understand, especially if you are paying for advice.

- How are funds being allocated or divested based on a post-Covid marketplace where certain sectors and stocks may be in dire straights (travel, leisure, restaurants, bricks and mortar retail, etc.).?

- What will my total fees be if I commit X: set up, monthly platform, annual advisory?

- Are there discounts based on the number of trades or length of time I am with the fund?

- Do you advise on SIPPS?

- Are you affiliated with any funds or are you independent?

- At what age can I expect to start receiving income from my pension investments? And will they be taxed?

How safe are your savings?

Most banks and pension funds only guarantee your savings up to £85,000. If you bank with a regulated bank or building society in the UK then some of your cash is protected by the FSCS (Financial Services Compensation Scheme), but only to a maximum limit up to the value of £85,000 per person or £170,000 for joint accounts.

That is why you should check out National Savings and Investments (NS&I), which is the only provider that secures 100% of your savings, however much you invest if you cannot find a better rate or if you want to spread your savings among a few providers to be secure. NS&I’s rates are not high, but they are backed by HM Treasury. NS&I holds deposits of one-third of UK savers – that is roughly 25 million people. Many have deposited through their Premium Bonds.