Estonia is launching a Digital Nomad Visa to attract talented people from around the world who can work independent of location and timezone. It is also a way to ensure that nomadic workers are taxed, something many governments across Europe have turned a blind eye to.

The Freelance Informer did a little digging to see how Estonia, the latest and much awaited DNV market, compares to others when it comes to cost of living and the Visa paperwork to make the move worth it or even possible.

Other DNV markets include Germany, Costa Rica, Norway, Mexico, Portugal and the Czech Republic.

Europe’s digital nation

Estonia is already known as a ‘Digital Nation’. It’s the birthplace of Skype and digital banking app Transferwise, and also E-Residency, a government-issued digital identity and status that provides access to Estonia’s transparent digital business environment. For those not already familiar with E-Residency, it enables digital entrepreneurs to start and manage an EU-based company online and manage the business from anywhere, entirely online. This could mean opening up an international customer base, which means more projects and more experience to put on your LinkedIn profile or personalised website.

In addition to being the the first country to offer e-Residency, it would seem only natural that it would launch a work Visa programme especially suited for Digital Nomads- those individuals that have the skill set, solopreneur mindset, existing client base to ability to work remotely (which is not the same as Work-From-Home) and are open to living in another country than their clients or employer.

Usually, they will have clients from their home country or even other markets, where they have worked previously or built up an international client base through freelance or project-based work. They have likely made a name for themselves in their given area of expertise.

“From Tartu to Tallinn, in the bogs, through the forests, and on the beaches, there is an exciting startup scene and rich ancient culture and landscapes here waiting to be discovered and explored by diverse entrepreneurs and global citizens, no matter where you are from or what sector you work in,” says Ott Vatter, Managing Director at e-Residency.

Estonia’s DNV could potentially bring more then 1,800 remote workers to Estonia per year. The government is also hoping that by having some of the world’s most successful remote workers in the world living and working inside its country, Estonian-developed software applications and related businesses will be readily adopted by this international and influential workforce.

“Estonia understands the necessary need for visa to be revolutionised in the 21st century,” according to an AllianceVisas report, a website that keeps travellers and those looking to work abroad or emigrate to different countries updated on Visas.

Estonia’s Ministry of Interior believes that the DNV will be granted for both short-term and long-term stay intentions, according to a SchengenVisaInfo.com report.

In a statement, Estonia’s Prime Minister Mart Helme said, “A digital nomads visa strengthens Estonia’s image as an e-state and thus enables Estonia to have a more effective say on an international scale. It also contributes to the export of Estonian e-solutions, which is especially important in recovering from the current economic crisis.”

According to minister Helme, the general conditions for issuing visas apply when issuing a digital nomad visa, noting that minimizing the risks of misuse was also taken into account when developing the changes. He stressed that “by default, no digital nomad is entitled to a visa and their background is checked as carefully as for other visa applicants”.

What are the requirements?

Vatter outlines in a Medium.com post that the base requirement will be one of the following:

- You work for a company that is registered in a foreign country and you have a contract of work with that company;

- You conduct business activity for a company that is registered in a foreign country and of which you are a partner/shareholder; or

- You offer freelance or consulting services mostly to clients, whose permanent establishments are in a foreign country, and with whom you have contracts.

“Some e-residents may qualify under categories one or two if they work for a foreign employer or run their own business that is registered abroad,” Vatter explains.

“For e-residents who are running their business through an Estonian company, e.g. as a freelancer or solopreneur serving clients predominantly in foreign countries, they can also take advantage of the DNV under the third category,” according to the e-Residency Managaing Director.

The other important eligibility requirement to be aware of is the monthly income threshold, which is €3504 (gross of tax). You will have to show proof that you have generated this consistently for the past six months. For some, that have been working for boom sectors during the COVID-19 crisis, that may nto be such a problem. For those that have seen freelance or contracted work slow or dry up, this could be a major thorn in your plans. Therefore, if you are serious about making the move to Estonia or the other DNV markets you might have to really push your self-marketing skills to attract new clients and projects or more predicatble monthly assignments.

Therefore, you will be required to show that your business is capable of being run from anywhere and that your clients and income come from outside Estonia.

The dreaded topic of taxes and admin

“The digital nomad visa concept is definitely raising eyebrows all over the world as we hear more and more countries discussing the possibility of launching it,”Kristin Kirštein, Head of Growth, at company e-company registration, invoicing and accounting firm Xolo.

“Regarding taxes, all of the usual regulations also apply to digital nomads. Digital nomads have to pay taxes in the country where they are considered tax residents,” Kirštein tells The Freelance Infomer.

“For example a person is considered a tax resident of Estonia when they reside here for at least 183 days during a 12 month consecutive period. Digital nomad visa can last for up to 1 year so in that case the person might become a tax resident of Estonia and pay their personal taxes here,” she explains.

Xolo’s customer base consists predominately of independent professionals such as software developers/It consultants, Creative & Marketing, Translators and Business consultants. Companies, such as Xolo, are gearing up to help digital nomads with setting up a solo business that can be then managed from anywhere in the world. Xolo, for example, takes care of admin tasks such as accounting and expense reporting and also reports corporate taxes in Estonia.

In Estonia, the 20% corporate income tax can be deferred and re-invested into the company if dividends are not paid out, according to Kirštein.

Xolo has gathered the most important digital nomad visa related information in its blog, which you can read here.

When in Rome…

Each country that issues Digital Nomad Visas or something similar has a different application process, rules, paperwork and even restrictions on the sector you work in. In the case of Estonia the visa costs €80 for a short-stay (Type C) and €100 for a long-stay (Type D), according to International Working site, Where Can I Live. You can get more details about Estonia’s application process here.

Thailand, for example, has what it calls a ‘smart visa’, which allows workers to travel and work in Thailand without a permit. However, the smart visa is only available for those who work in the ‘S-curve’ industries such as automation, robotics, biotech and next gen automotive. This visa will allow workers to to stay for four years compared to one year previously, according to Where Can I Live. The site is worth checking out since it has some of the latest details on other DNV markets, some of which do not have as high income thresholds as Estonia, such as Spain. But you have to also weigh up the costs of running a business, which include administration and accounting costs. Expat advice site, Expatica is a good place to start to get a better idea of such costs.

Cost comparison?

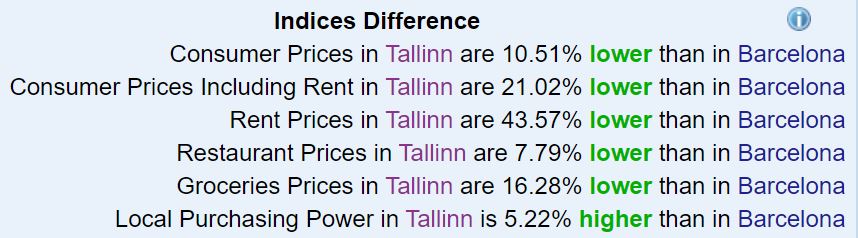

You would need on average EUR 2,685 in Tallinn to maintain the same standard of living that you could with EUR 3,400 in Barcelona (assuming you rent in both cities), according to Numbeo, a comparison site estimated costs of living in different cities.

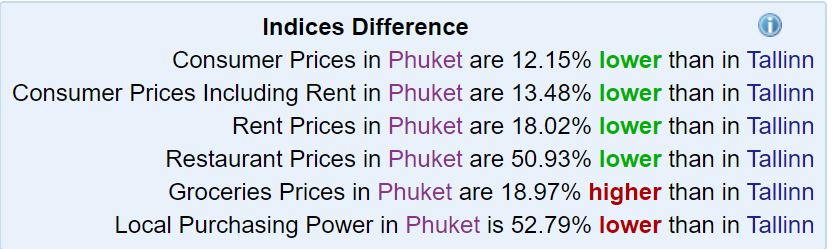

Other Numbeo city comparisons below are London v. Tallinn and Thailand’s Phuket v. Tallinn

Estonia, definitely has its perks when it comes to solopreneurs or those that have the flexibility with their employers or businesses, namely the ease and speed to set up a business there. And for those that are happy to stay in their home market for now, Estonia always welcomes those that want their business to reach international customers through their e-Residency and related admin service companies.