Can’t pay your tax bill on time? There’s still hope. That is if you are not among ‘The Excluded’

The HMRC has extended the payment on account deadline for Self Assessment to 2021 and also set up self-employed loan support in these lean times. But not all taxpayers are feeling the love. Some 3 million have been left in a taxpayer’s black hole.

If your Self Assessment payment on account was due in July 2020 the HMRC has reported that you may have the option to defer or delay payment until 31 January 2021 due to those individuals and businesses affected by coronavirus (COVID-19). HMRC will not charge interest or penalties on any amount of the deferred payment on account, provided it is paid on or before 31 January 2021.

The extension to pay has been welcome news for many of the UK’s self-employed, freelancers, and contractors who may have suddenly had client work dry up. However, other factors are coming into play. To make matters worse many UK small business owners are falling victim to late payments, as previously reported by The Freelance Informer.

HMRC has said that you do not need to tell them if you have chosen to defer your payment on account. Also, if you do defer, it will not stop you from being entitled to other coronavirus support that HMRC provides.

You must, however, make your second payment on account on or before 31 January 2021 if you choose to defer. Other payments you may have to make by this date include any:

- balancing payment due for the 2019 to 2020 tax year

- first payment on account due for the 2020 to 2021 tax year

You can check payments you need to make towards your next tax bill by signing in to your online account.

If you owe less than £10,000, the HMRC suggests that you might be able to set up a Time to Pay Arrangement online. This allows you to pay your Self Assessment tax bill in instalments.

Contact the HMRC coronavirus (COVID-19) helpline if you cannot pay any other tax bills because of coronavirus.

SEISS: who can claim?

Self-employed workers affected by coronavirus (COVID-19), may have claimed a grant through the Self-Employment Income Support Scheme for a financial buffer during the lockdown, to help pay tax bills or to just weather the anticipated downturn this autumn. But they were on a deadline to apply and claim. However, not everyone was included, accounting for a 10% ‘black hole’ of support for more than 3 million taxpayers.

The SEISS allowed claims to a taxable grant to be worth 80% of your average monthly trading profits, paid out in a single instalment covering 3 months’ worth of profits, and capped at £7,500 in total.

Those that can apply include a self-employed individual or a member of a partnership and all of the following apply:

- you traded in the tax year 2018 to 2019 and submitted your Self Assessment tax return on or before 23 April 2020 for that year

- you traded in the tax year 2019 to 2020

- you intend to continue to trade in the tax year 2020 to 2021

- you carry on a trade which has been adversely affected by coronavirus

If you claim Maternity Allowance this will not affect your eligibility for the grant.

To work out your eligibility HMRC will first look at your 2018 to 2019 Self Assessment tax return. Your trading profits must be no more than £50,000 and at least equal to your non-trading income.

“If you’re not eligible based on the 2018 to 2019 Self Assessment tax return, we will then look at the tax years 2016 to 2017, 2017 to 2018, and 2018 to 2019,” said the HMRC.

After going through the criteria for eligibility, you would have had to make your claim for the first grant on or before 13 July 2020.

The scheme was, however, extended. “If you’re eligible for the second and final grant, and your business has been adversely affected on or after 14 July 2020 you’ll be able to make a claim from 17 August 2020. You can make a claim for the second grant if you’re eligible, even if you did not make a claim for the first grant,” stated HMRC.

3 million excluded and counting

Limited companies or those operating a trade through a trust cannot apply for the grant. This has led to millions of UK taxpayers being excluded from government support (see below). This has caused much uproar and financial devastation for taxpayers that feel they have been left behind and many cases cheated.

ExcludedUK, a grassroots NGO launched in May 2020, is serving as a collective platform for those entirely or largely excluded from UK Government Covid-19 financial support measures, with a rapidly growing community of nearly 14k Facebook group followers.

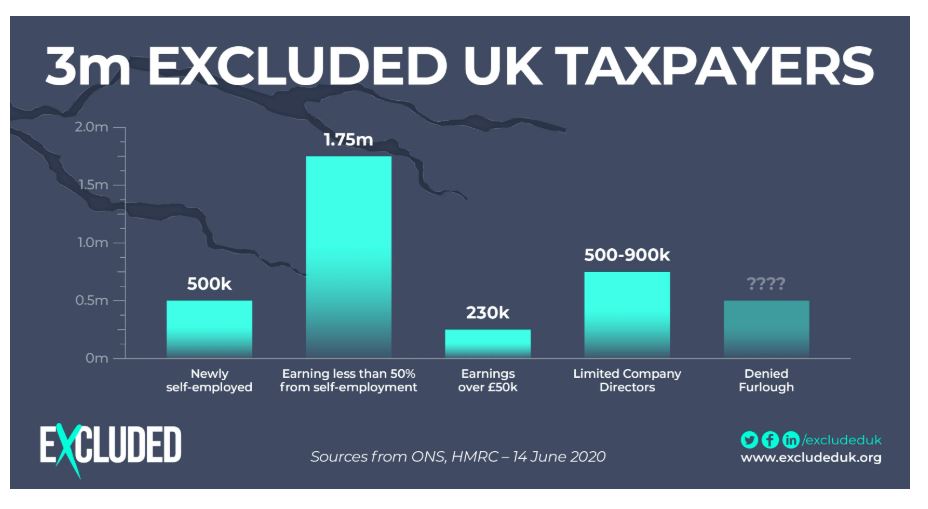

Based on statistics from the Department for Business, Energy and Industrial Strategy as well as the Office for National Statistics, Excluded UK estimates that at least 3 million have been excluded from government Covid-19 financial support packages, making up 10% of the nation’s workforce.

One of Excluded UK’s Community members, Mark, said he initially took great comfort in the Chancellor’s words. “He said he would not leave anyone behind and he would do whatever it takes with no limits imposed on the amount of help that the state would provide. Then we find out the devil is in the detail and actually it applies to most people. But my definition of all is all, not most, but all. I simply cannot understand that this [exclusion] can be even contemplated by a British Chancellor. I find it shameful and sometimes, at the moment, I am ashamed to be British. I feel it that profound a betrayal of hard-working people,” said the curtain fitter.

Mark set up his curtain fitting business in 2019 after many years working as a curtain fitter for high street brand John Lewis. He took the plunge into self-employment, but following lockdown had to close his business and was then excluded from SEISS due to not having sufficient tax returns to claim. Essentially, penalised for being newly self employed despite decades of paying tax through his PAYE job.

Mark has talked to the BBC news about his situation and in the words of Excluded UK, has “been brave enough to talk about how his mental health has suffered through this difficult time.”

Sonali Joshi, Excluded UK co-founder and Head of Policy, Communications, and PR Strategy, said in an IPSE webinar that the millions affected are feeling penalised and by no fault of their own actions. For example, many of the newly self-employed, those that started trading after April 2019, have no lines of support, and if a limited company, a double blow.

According to Joshi, the Treasury is under the impression that any claims from newly formed companies could run the risk of fraud. Joshi explained in the webinar that this has painted an inaccurate and insulting scenario for those that took the courage to set up their own business.

Andy Chamberlain, Director of Policy at IPSE, suggests that the HMRC could avoid fraudulent claims and include newly formed companies if they accept accounts for 2019/20, all of which could be assigned of a Unique Tax Reference.

Chamberlian mused that the reasoning behind the fraud threat poses the question,’ just how easy is it to generate a fake UTR and set up a business in the UK?’ Chamberlain says many might assume that now more than ever, the HMRC would already have protocols in place to bolster security and stamp out fraud.

The singling out goes beyond the newly self-employed and can include those that are widows and who have received benefits in recent years, those under the 50/50 self-employed rule, and those that previously drew down in part on their pension to invest into their business, to other vague exclusions.

“It is simply unacceptable that many individuals are ineligible for every kind of support, even Universal Credit, for entirely arbitrary reasons,” said Jamie Stone, Liberal Democrat MP and Chair of the APPG for ExcludedUK.

According to Joshi and Stone, the Excluded UK APPG was the largest ever attended inaugural APPG meeting.

“The fact that so many MPs have requested to take part is testament to how many of us want to see the Government help the 3 million people who have been left behind during the pandemic,” said Stone.

“The Chancellor must stop burying his head in the sand,” said Stone.

Stone believes that the Chancellor must not only respond to the Treasury Select Committee Interim Report and its recommendations for how to help all those who have been excluded, but also commit to a meeting with the APPG and Excluded UK as a matter of urgency.

Freelancers-to-founders caught out?

Newly formed UK startup companies often start with a two-person team, often IT contractors or freelancers-turned-founders. They are often specialising in market disruption technology or scientific applications and will have more than likely set up under a limited company structure for tax efficiency and limited liability. If such companies are left to fall between the cracks, they may have little choice than to throw in the towel or take their business to another market, such as the US, if they feel their startup or technology may be better supported elsewhere.

This nearly happened had not some of the UK’s most celebrated startups had not spoken up. For example, startups that were awarded spots in Silicon Valley and US accelerator programmes – such as 500 Startups, Y Combinator or Techstars, prior to the pandemic with a view to growing the business back in the UK, many were to learn that they were now not eligible for government support under the Future Fund’s current terms, according to a City AM report.

More than 30 founders of Britain’s brightest startups wrote to the Treasury asking them to modify the terms of the loan scheme so that startups without a UK parent company, but whose majority of employees are based in the UK, could be eligible, according to the report.

Then at the end of June, the UK government changed its tune and reported that is was expanding its COVID-19 support for startups, offering more cash and extending the eligibility criteria to firms with headquarters overseas.

The Future Fund now provides government loans to UK-based companies ranging from £125,000 to £5 million, subject to at least equal match funding from private investors.

The British Business Bank, which operates the Future Fund, said it will carry out more in-depth checks on applications from overseas companies to ensure public money is not being misused, Yahoo Finance reported.

If you are among the Excluded self-employed workers in the UK and want your voice heard you can sign a petition directly to the Government, and one that is addressing your situation via this link. You can also take part in Excluded’s series of real-stories.

Self Assessment Payment Helpline

Telephone: 0300 200 3822

Monday to Friday, 8am to 4pm

Find out about call charges