Pension tax is pushing NHS doctors into early retirement. Will locums fill the gap?

The number of doctors taking early retirement from the NHS has more than trebled over the past 13 years, official figures show. Many retired because of the large tax bills spurred by pension caps. Will locum doctors cover the exodus?

A BMA survey demonstrated that 72% of doctors would consider retiring early. The pandemic arriving in parallel as the lifetime pension allowance being imposed could result in a mass exodus of highly experienced doctors, at a time when patients need them the most.

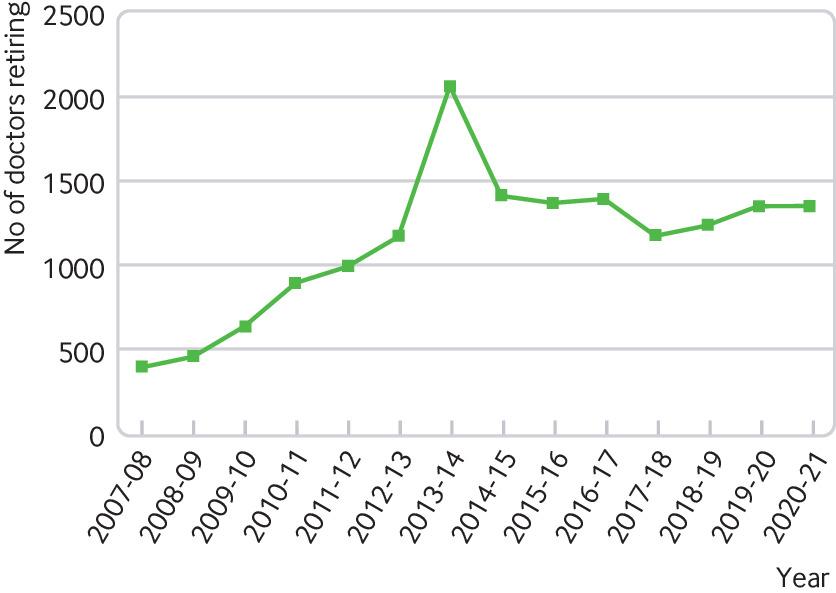

In 2020-21 1358 GPs and hospital doctors in England and Wales took voluntary early retirement or retired because of ill health, up from 401 in 2007-08 (fig 1).

Overall, the total number of doctors retiring rose by 21% over this period, from 2431 in 2007-08 to 2952 in 2020-21. The total number of doctors employed by the NHS in England and Wales rose by 25% over this period, from 141 000 to 176 000.

The figures were provided to The BMJ by the NHS Business Services Authority in response to a freedom of information request. They relate to doctors who claimed their NHS pension in a specific pension year, some of whom may have returned to work in the NHS in other roles after claiming their pensions.

As the number of doctors retiring early has risen, the number retiring on the basis of age has fallen: from 2030 in 2007-08 to 1594 in 2020-21. The average age at which doctors are retiring has also fallen over this period, from 61 years in 2007-08 to 59 in 2020-21.

BMJ/NHS Business Services Authority

Pension tax is pushing doctors into retirement

Changes to pension tax regulations since 2010 have left many senior doctors facing large tax bills. The BMA said that changes to tax regulation were one of the main reasons prompting doctors to retire, a situation confirmed last week by the financial watchdog the National Audit Committee.

The fluctuations in the number of doctors taking early retirement also reflect this, showing sharp increases in some years. For instance, in 2013-14 2069 doctors took early retirement ahead of the changes to the NHS pension scheme in 2015.

The BMA has warned that successive failures in government recruitment and retention schemes have meant that the UK has been seriously short of doctors for many years.

Commenting on the new figures, Vishal Sharma, chair of the BMA’s pensions committee, said that repeated surveys from the BMA had shown that more than half of doctors planned to retire before the age of 60, with most citing pension taxation as their primary reason. He said that the current pension taxation system was “punitive” and left “senior doctors with little option but to consider early retirement.”

Pandemic is exacerbating doctor burnout

The strain of working through the pandemic has left many doctors exhausted and battling stress and burnout, Sharma added. “Many have had their annual leave cancelled, and they have not had adequate time to rest and recover from the tumultuous year they have had, with no sign of let up as they now face the biggest backlog and waiting lists since records began.”

Sharma said that the situation had been exacerbated by the government’s decision to freeze the lifetime allowance for pensions taxation for next five years, which will increase the amount of tax that many doctors have to pay on their pensions.

“A BMA survey demonstrated that 72% of doctors would consider retiring even earlier as a result of these changes,” he said. “The combination of an exhausted workforce coupled with the freezing of the lifetime allowance being imposed at the same time will potentially result in a mass exodus of highly experienced doctors, at a time when patients need them the most.”

Independent workforce to ease NHS staff shortage

Staff shortages are “endemic” across the NHS and not restricted to one area of health and social care. MPs on the Health and Social Care Select Committee have issued a report that noted the high levels of vacancies immediately prior to the pandemic, including the need for 40,000 extra nurses in England alone.

It concludes that without adequate funding, the NHS People Plan’s aspirations will not become reality and its delivery will depend on the level of resourcing allocated to it. It also concludes that annual, independent workforce projections would help provide the health service with the clarity required for long-term workforce planning.

Chair of the Committee, Jeremy Hunt MP, said, “Achieving a long-term solution demands a complete overhaul of workforce planning. Those plans should be guided by the need to ensure that the long term supply of doctors, nurses and other clinicians is not constrained by short-term deficiencies in the number trained. Failure to address this will lead to not just more burnout but more expenditure on locum doctors and agency nurses.”

Should NHS follow judiciary’s retention scheme?

He said that a “simple but effective” change that the government could do would be to implement a tax unregistered pension scheme in the NHS. “The government has already implemented such a scheme for the judiciary to address similar recruitment and retention issues,” he said. “A comparable solution within the NHS will allow our most experienced doctors to remain working in the NHS and consequently avert this workforce crisis.”

Is locum pay going up or down?

The proportion of NHS spending on doctors’ wages that is spent on agency workers is higher than that for other staff groups, according to a BMJ report in 2019. The proportion of NHS spending on medical staff that is spent on agency workers was 7.0% in September 2018.

Liaison, a company that manages staff payment systems, gathered data on the pay and agency commission rates paid to over 5500 bank and agency doctors by 55 NHS trusts between July and September 2018. The company found that, over this period, the average locum pay for all doctors was £74.74 per hour. The average for consultants was £101.21; for higher trainees it was £70.68; and for staff grade doctors it was £68.07.