In 2014, when an accident on a building site resulted in the death of their mutual friend, the founders of US-Australian Safesite were inspired to launch a platform to streamline and digitize safety programmes. That app has since inspired yet another startup, Foresight, an Insurtech company based out of Safesite’s San Francisco office, which uses Safesite’s data to determine workers’ compensation.

Foresight claims it is shaking up the traditional workers’ compensation model. By wrapping risk management technology and services into every policy the founders have found a niche in Insurtech.

For those UK-based freelancers in the software engineering, HSE or construction tech or insurance, watch this space.

Friends and founders

Longtime friends and Safesite and Foresight co-founders David Fontain, Peter Grant, and Leigh Appel are working to eradicate site-related accidents and fatalities by bringing more clients and projects on board to their app.

The trio raised USD15m in funding back in May (under Safesite), according to a Techcrunch news report, with participation from Blackhorn Ventures and Transverse Insurance Group. To date, it has raised USD USD20.5 million from industrial technology venture capital firms, led by Brick and Mortar Ventures and Builders VC.

Foresight launched in August of this year but has already covered USD30M in risks, said Techcrunch. The company says it is now on pace to reach USD50M in underwritten premium in 2021.

The USP

By leveraging the data from sister company Safesite, the platform says it has been able to reduce workers comp incidents by up to 57% in a study conducted by actuarial consulting firm Perr & Knight.

“Our risk management technology has been evaluated by a top actuarial firm and found to consistently reduce incident frequency by up to 57%,” says Emilio Figueroa, Foresight’s Chief Insurance Officer. “Because our technology is effective, we’re able to offer competitive rates for hundreds of class codes spanning the construction, manufacturing, logistics, light industrial, and agriculture verticals.”

Where lowering workers’ compensation premiums generally takes at least three years, Foresight monitors safety engagement and rewards proactive insureds sooner, it said.

The company is looking for brokers in the US, but given the universal tie-in with the Safesite safety management app, UK brokers may want to consider the Insurtech app’s potential for the UK market, once they look into the matter further.

Recruitment agencies, umbrella companies, recruitment tech and end-hiring companies should also be looking into this segment as they will have access to valuable data required for worker compensation and it could drastically cut premiums.

Often, to determine a worker’s compensation, their timesheets will have to be analysed, which depending on the timesheet process could get complicated if the worker works through an agency as an independent contractor.

However, if these individuals are listed under the wrong job or trade classifications, the hiring company is likely paying too much, or maybe too little, for their worker compensation policy, according to Foresight. Either way, incorrect classifications open them up to risk when it’s time to file a claim. From the reverse perspective, when an employee is misclassified as an independent contractor, for example, in the US, it opens up legal risk and may cost quite a bit more in the long run.

Health & Safety: UK v. US

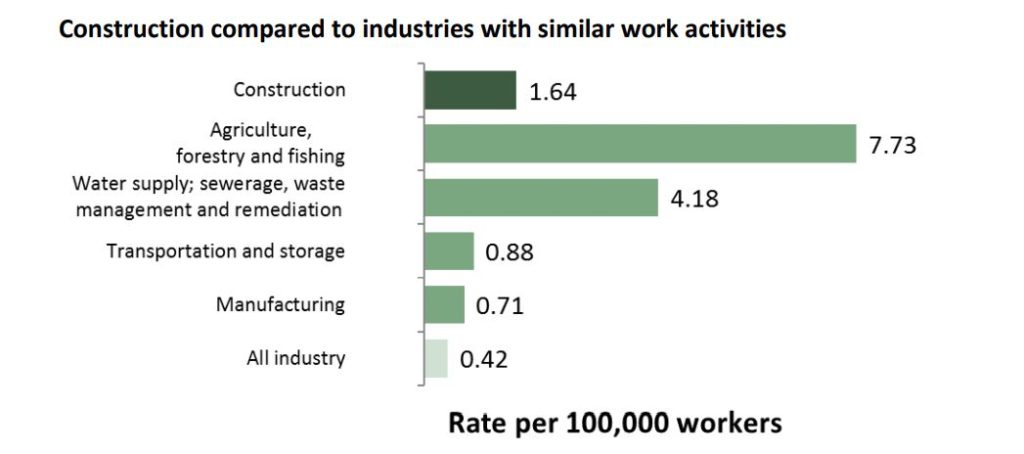

In the UK Construction sector, there were 40 fatal injuries to workers and four to members of the public in 2019/20, according to RIDDOR (HSE). This means that there is an average of 37 fatalities to workers and five to members of the public each year over the last five years. Notably, 47% of deaths over the same five year period were due to falls from height.

Given the vast size of the US market, the number of fatalities is on another level, a very dangerous one at that. In 2018, 5,280 workers died as the result of a work-place injury in the US, which was a 2% jump from 5,147 in 2017. Out of these, 4,779 worker fatalities were in private industry.

“It’s common for middle-market, blue-collar businesses to invest heavily in safety improvements while also paying high workers compensation premiums,” says David Fontain, founder and CEO of Foresight. “We’re using technology to strengthen the correlation between safety and lowered premiums so that industry in the US is more profitable and safer overall.”

Gap in the market

The company says this segment of the insurance market has been largely overlooked by well-funded InsurTech startups such as Next Insurance and Pie, which provide small business policies under $50K in annual premiums.

Next Insurance, for example, an insurance startup serving small businesses and freelance workers said it recently raised USD250 million (£196.45) in funding and was now valued at over $2 billion, more than doubling its valuation from late last year, according to its Chief Executive Officer Guy Goldstein.

Like we said, watch this space (and the funding).