Freelancer rates in these sectors could soar

A lot has been said about employment, inactivity and job vacancies over the pandemic, but what’s happening to earnings? Salary trends in earnings using payroll data from HMRC revealed which sectors are seeing the highest pay rises. Is it time freelancers adjusted their rates accordingly?

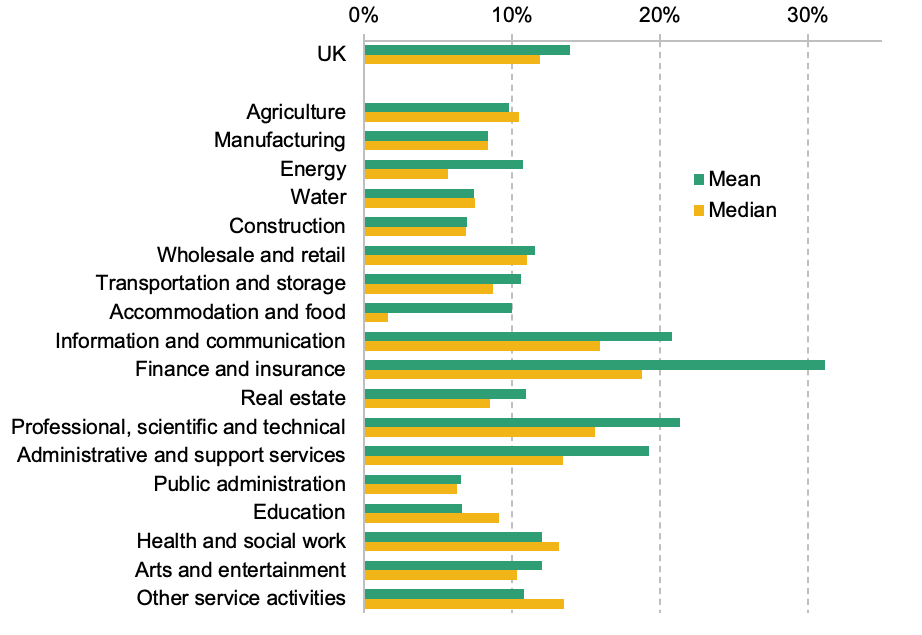

- According to ONS figures, total pay (including bonuses) grew 7% in the year to January-March and regular pay was up 4.2%. However, after inflation, total pay is up 1.4%, and regular pay is down 1.2%.

- In the public sector, total pay was up just 1.6%, compared to 8.2% in the private sector.

“There has been a sharp rise in pay in the finance and insurance sectors in recent months, at levels not seen in the last decade,” says Xiaowei Xu, a Senior Research Economist at the Institute for Fiscal Studies.

By February 2022, average pay in both sectors (“finance”) was 31% higher than in December 2019 in cash terms, whilst average pay across all sectors was just 14% higher. This implies a real increase of 23% and 7% respectively. But other related industries are also seeing salary hikes.

The rapid pay growth in finance is also seen in data from the Monthly Wages and Salaries Survey (MWS), which shows an increase in mean pay of 15% over the same period in the finance and business services sector – a wider industry grouping that includes real estate and professional and administrative services – compared to 11% across all sectors.

Source: PAYE RTI data, April 2022

Xu says the gap between finance and other sectors started opening up in autumn 2021 – before bonus season – and the recent surge in pay far exceeds any seasonal trends that can be seen in previous years.

“The MWS survey data further suggests that the bulk (nearly 80%) of the pay rise in the ‘finance and business services’ sector is due to an increase in regular pay, rather than bonuses, though the wider industry aggregation might obscure what’s happening in finance specifically,” says Xu.

Xu says there is no obvious reason why pay in the finance sector has increased so much since 2019.

There was no increase in labour market tightness – which could increase employees’ bargaining power vis-à-vis their employers – over and above what we see in other sectors. Output in finance did not appear to increase either compared to other sectors.

However, very high profits could be the answer as reports of some large banks saw revenues surge following mergers and acquisitions (M&A) over the pandemic.

While it is difficult to compare profits across sectors, output in the finance sector as a whole does not appear to have increased more than in other sectors. Whilst output (GVA) in finance held up much better than other sectors in the initial stages of the pandemic, by 2021Q4 GVA in the sector was no higher relative to 2019 than in other sectors.

Brexit and older workers leaving the workforce have reduced the overall supply of workers in the economy, but the finance sector was no more reliant on EU migrants than the economy as a whole, and 50-70-year-olds working in finance have not become more likely to leave the workforce (relative to 2016-2019) than those working in other sectors.

The number of vacancies in the finance sector in January-March 2022 was 43% higher than in January-March 2019 – no higher than the economy-wide increase of 52%.

Depending on which end of the pay spectrum you are as a freelancer: zero-hours gig worker or highly skilled contractor, the reversal of pre-pandemic trends towards greater pay equality may imply higher inequality in household incomes in the years to come.

“Government support over the pandemic – including the £20 a week uplift to Universal Credit and the furlough scheme – led to a reduction in household income inequality between the 2019-20 and 2020-21 financial years,” says Xu.

Since April 2021, the combination of lower pay growth for low-earners (relative to both high-earners and inflation), below-inflation benefit rises and the withdrawal of the £20 uplift means that prospects for low-income households are now much bleaker. In contrast, strong pay growth among the very highest earners could push up the top 1% share of household incomes, which has remained stable over several years.