Solopreneur millionaires on the rise

The growth of solopreneur millionaires is surging, not just in the UK, but in the US and across the globe. For some one-person businesses, becoming a millionaire is when they see their pension pot hit the £1m mark. For others, it is getting a major win with a large brand and seeing revenues grow year on year to support their influencer lifestyle. And for a growing number of social media influencers, such as Home Workouts guru, Joe Wicks, they have transformed into their own self-made brands worth millions.

As a fellow or inspiring freelancer you may be thinking, how do they do it? Dedication to their craft and becoming a brand in their own right seems to be the secret sauce. To engage an audience as an influencer you should have more than one outlet to offer your services or products, both of which will represent a place that people can turn to for advice, empowerment and knowledge. Your aim is to help people attain their end goal.

That means doesn’t necessarily mean you have to be shelling out beauty, fashion or workout tips to be an influencer. Just think of what you do best and think of brands or clients that could harness your craft to enhance their brand, products or services. That’s where you begin.

But just how many followers do you need to make a living solely from Instagram, YouTube or TikTok?

According to LIckd, a UK agency that provides soundtracks for millions of videos suggests to bring home the average UK salary of £31,500, a typical user would need:

- 10,500,000 YouTube views

- 121,000,000 TikTok views, or

- Around 125 sponsored Instagram posts

That goes to show that a lot of work will have to go into preparation, presentation and filming the videos before any revenues come in. And the other thing is you can’t just be a one-hit-wonder. You have to provide more content.

For example, the fitness boom has grown exponentially over the global lockdown. This growth has seen some influencers become overnight sensations. Yet, they would have been grafting for months if not years to claim those advertising revenues or grab the attention of an influencer agency to get signed with a major brand.

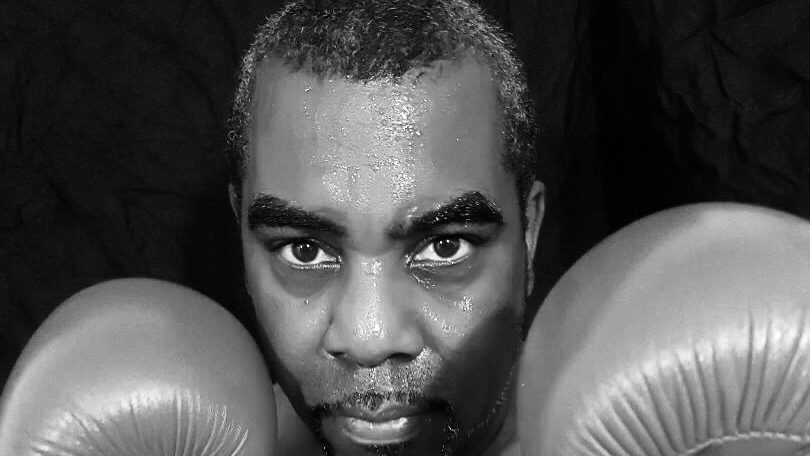

When things do come aligned, it seriously pays off to make it big as a health and fitness influencer. Topping the rich list is Simeon Panda, who – based on cost per impression – could have raked in up to $140 million from his presence on YouTube, Instagram and TikTok, according to research by Currys PC World. This works out to approximately $17.5 million a year.

“He’s also the top-earning fitness Instagrammer, with $17.4 million of his yearly earnings coming from this platform alone. Off the back of his success, he launched his own sports brand called Just Lift and is now somewhat of a celebrity in the fitness world,” said Currys who compiled a ranking of the world’s most influential and wealthiest fitness social influencers.

Age doesn't matter when it comes to becoming a solopreneur or influencer

The other thing about solopreneurs is that they don't fit into just one age group. Startups.co.uk analysed data from a number of publicly available sources including Companies House, The Sunday Times Rich List, the FT, How They Started, to find out how old the UK’s most successful entrepreneurs were when their businesses first made £1m turnover. The average age is 31.

However, the report said that with ages ranging from just 17 up to 50, it shows that there really is no upper or lower age limit to finding business success.

One of the UK's most famous solopreneurs to make their first million in their fifties is Jamaican-British entrepreneur Levi Roots. According to a Startups report, the former Notting Hill jerk chicken stall owner whose real name is Keith Valentine Graham had run the store at Notting Hill carnival for 15 years before he was spotted in 2006 at the World Food Market by a BBC researcher.

Soon after he was discovered by the researcher (he already had customers as fans) he went on to pitch his famous jerk chicken sauce on Dragons’ Den and scooped £50,000 from Peter Jones and Richard Farleigh. That exposure landed Roots a deal with supermarket chain Sainsbury’s. Sales reached £1m within the first year when he was 50 years old and Levi Roots Reggae Reggae Foods became one of the Den’s most successful businesses ever, Startups reported.

The Freelance Informer published a report on why people over 50s are starting up their own businesses out of survival or for more control over their future success.

ONS data showed employment among the 25-49s is now back at the rate it was at the start of the pandemic, whereas the employment rate among 50-64s has fallen by 1.3 percentage points.

A report published in April by the Resolution Foundation also noted the U-shaped crisis facing 18-25s and over-50s, who are the most likely to struggle to obtain full-time work as a result of the pandemic.

Payments still a problem for influencers

Freelancers at some point in their career have had to handle the common downside of being independent: late payments. Now that millions of freelancers have come onto the market over the pandemic, notably in the US, freelancer payment startups have started to emerge.

Those in the US include Willa, Archie and Karat Finance and are attracting large investors to back the freelancer movement. But what about across the pond?

Sifted, the FT-backed startup news site, recently reported that XPO, a new digital banking app for influencers, has been launched in the UK.

The app offers a speedy invoice-financing solution that allows users to get paid within 24 hours of completing a job. The report said that the app is set to onboard thousands of British content creators. In its first week, it paid out £20k in its first two days of going live.

XPO cofounder Lotanna Ezeike told Sifted that the plan is to build an entire financial ecosystem around young creatives and influencers.

“We found that traditional banks didn’t understand how creators earn money (they don’t really care to be honest). So we had the crazy idea to help content creators have access to better banking services,” said Ezeike, who previously worked at Barclays.

XPO [is] tackling invoices first by funding creators. Then the data collected will be used to provide predictive data on the future earnings of a creator and allow access to credit and other banking facilities.

If you know a solopreneur that would make a great Q&A candidate for The Freelance Informer, please nominate them. They can find our 20 interview questions here:

If you know a solopreneur that would make a great Q&A candidate for The Freelance Informer, please nominate them. They can find our 20 interview questions here: