Marriage and life spans: it’s time to talk about money

A personal finance expert highlights some alarming trends when it comes to money and marriage. Are you in a position to preserve financial security for not just yourself but your loved ones and children?

Whether you’re in a marriage, partnership or long-term relationship if you co-own or think you co-own assets, you are probably overdue for a financial overview of where your money sits and who is controlling and investing it. When it comes to money talk it is best to address your finances in a practical, factual and pragmatic way. Easier said than done to keep emotions aside, but the process aims to make sure you and your loved ones do not end up financially worse off if the relationship breaks down or one of you dies.

Where’s the money?

“How strong is your marriage?” asks Sarah Coles, the head of personal finance at Hargreaves Lansdown. Admittedly, Coles admits this “isn’t a pleasant question”, but while there are plenty of happily married couples sharing assets to save tax, she says there are also plenty more who face divorce with half their assets in their spouse’s name.

“Technically they can’t spend their way through it as an act of revenge,” says Coles, “but in reality, this is incredibly difficult to enforce.”

The second question Coles poses is, “What is your spouse’s relationship with money?” She suggests in some cases, you need to consider whether your spouse will take the same approach to ISAs as you, or whether they will spend money you would prefer them to invest for the long term.

“In others, you will see eye-to-eye on spending, but you need to consider your approach to investments, too,” says Coles.

To address some of the different money mindsets, each of you write down on a separate piece of paper what you want your lifestyle and work life to look like in two, five, ten and 15 years. Then compare notes and discuss how these life and work goals can be shared and achieved through budgeting, saving and investing and how to ensure both parties have equal access to combined or individual assets.

Risks not worth taking

Coles sets out the potential risks when the scales are unbalanced. “If one of you takes control, there’s a risk they won’t match their partner’s objectives and risk profile. If you both take control of your own investments, it helps build a healthy understanding of your assets, which will stand you both in good stead for the future, but you need to be comfortable that this is now money that belongs to your spouse, and is theirs to make decisions with.”

Age matters

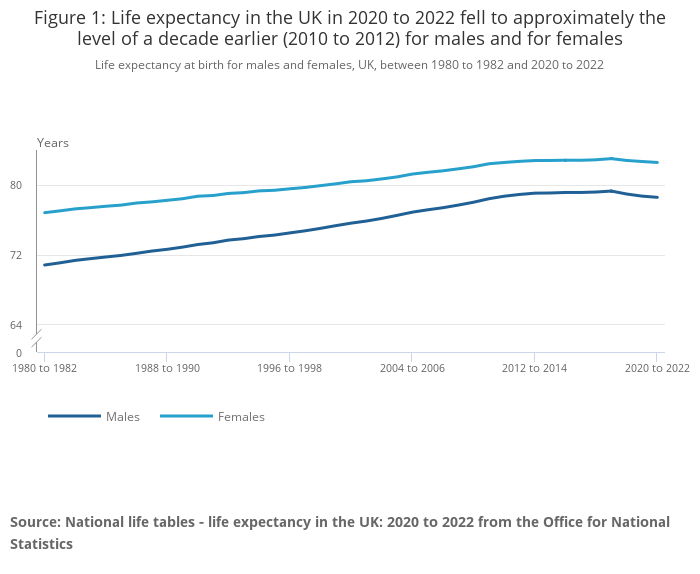

In 2011, until the age of 24, there were more men than women. By the age of 90, there were more than twice as many women as men, according to ONS figures.

“Women are set to hold the vast majority of the UK’s investment wealth.” That’s according to Coles’ estimations. But this shift in investment ownership is not because they are bigger investors than men, but because they live longer than men.

Coles is basing this shift purely on demographics: “Women outnumber men by more than a million, and their numbers are growing faster.”

This trend defies the biological norm of more boys being born, as women’s longevity surpasses that of men. Coles elaborates, “After overtaking men at 25, the numbers of men and women remain pretty similar throughout our working lives… However, by the age of 75 there are 12% more women, and by the age of 90, there are more than twice as many women.”

Compounding this effect is the tendency for women to marry later, she says. “Women not only live longer than men on average, they also tend to marry slightly older,” says Coles. “It means that in a typical couple, the wife will outlive the husband.”

That means women should have a very active part in saving and investing for their future without leaving it to chance or solely the responsibility of their partner, especially if the assets are solely in their partner’s name.

Financial literacy and control can’t be put off

This longevity disparity highlights the importance of financial literacy for women. Research by Hargreaves Lansdown reveals a gender gap in investment ownership: “Our research shows that men are far more likely to have investments than women: just under half of men have them (45%) compared to just over a third of women (36%).”

Coles says this poses a potential risk: “Even when they hold them together, there’s the worry that one of the couple will take overall control. And if it’s the man, there’s a risk he will leave his wife high and dry when he passes away.”

However, Coles finds optimism in a recent survey: “The good news is that when we surveyed 7,500 female savers and investors…we found that when women consider themselves savers and investors, more than half make their financial decisions alone and almost two in five make them with their partner.”

This financial confidence bodes well for the future. Coles concludes, “Almost three in five (59%) of them say they are financially confident, and half (50%) say they’re interested in investment. It means that if the worst happens, and they lose their partner, their savings and investments are one thing they won’t have to worry about.”